While filing for divorce, many thorny issues are likely to arise, one being the issue of alimony. Also known as spousal support, alimony is the payment made by one spouse to the other. The alimony payments often commence when spouses separate, intending to divorce. According to California law, a spouse may request temporary alimony, permanent alimony, or both. In most cases, alimony is in the form of month-to-month payments. However, lesser-known alternatives to monthly alimony payments exist. At Los Angeles Divorce Lawyer, we understand all the aspects of divorce and family law cases. Our expert lawyers will guide you through alimony payments, including the alternatives to monthly alimony payments.

Why People Seek an Alternative to Monthly Alimony Payment

Unlike child support guidelines that are predictable and consistent, alimony payment is a complicated process. At times, it's not even clear whether alimony should be paid at all. Determining which spouse should pay alimony, the payment amount, and how long the payment should last is often complicated and uncertain. The guidelines that exist regarding alimony payment mainly apply to temporary spousal support. However, even these guidelines do not define specific or predetermined dollar amounts. Alimony payment laws are more flexible and hard to predict.

Together with their divorce lawyers, both spouses must agree on the alimony payments, and present this agreement to the presiding judge. Some of the factors that determine the spousal support amount are:

- Each spouse's ability to maintain the standard of living they enjoyed while married once they are single again.

- The localities where each spouse will reside after the divorce and the cost of living in these localities

- The living expenses or the supported spouse's actual needs and supporting spouse's ability to pay based on their current and projected income.

- Whether the supported spouse contributed in any way to the supporting spouse's training, education, or professional license

- How long the couple has been married, their ages, and their health status.

- The division of communal properties during divorce — The court will also consider the division of debt responsibility during a divorce.

- Other factors that the court considers are the spouse who secures the custody of the child/children and the child support payments.

The factors outlined above are only a portion of what the court considers while setting alimony payments. Some of the factors why most people choose alternatives to monthly alimony payments are:

Change of Financial Status

Life is unpredictable, and if the supporting spouse or the supported spouse's financial situation changes, the monthly alimony payments might become unfair. The monthly alimony payments may have to be renegotiated in court when one or both spouses' financial situation changes.

Monthly Alimony Payments Affect Other Financial Areas

The monthly spousal support payments will affect every spouse's tax filings. Monthly spousal support payments may also impinge child support payment and lead to the supporting spouse's wage garnishment.

Supporting Spouse's Wage Garnishment

You may seek alternative monthly alimony payments to avoid wage garnishment, especially if you are still paying child support every month. The monthly alimony payments might be burdensome if you lose your job or have a lower-paying job. If your financial situation changes and affects your ability to make monthly spousal support, you may suffer since the court may not immediately adjust the alimony payments.

Uncertainty

Monthly spousal support may be uncertain for the supported spouse. Every month, the supported spouse will probably wonder whether the support will come. The supported spouse will have a constant uncertainty and anxiety that the other spouse might be unable or unwilling to pay the monthly alimony.

Numerous Disputes

Numerous disputes often surround monthly alimony payments. In most cases, whenever a dispute arises, the spouses have to go back to court and renegotiate the payment all over again. This is not just time-consuming but also inconveniencing.

Given the many issues surrounding monthly alimony payments, it's clear why most people prefer other payment options. Monthly payments may be beneficial to the supporting spouse since they will deduct the payment from their taxable income leading to tax savings. However, the supported spouse will receive a lesser alimony amount after the taxation.

The supported spouse may prefer monthly alimony payments to a lump-sum payment. Lump-sum payment requires ample planning, and the supported spouse might fear that they might end up spending the lump-sum too quickly. On the other hand, consistent monthly payments require less planning.

Alternatives to Monthly Spousal Support Payments

As long as both spouses and the presiding judge are willing to consider alternatives to monthly alimony payments, several options are available. Before signing any spousal support deal, it's essential to seek the assistance of an experienced divorce lawyer. A lawyer will guide you through the process of creating a fair alimony payment deal with your spouse. Some of the main alternatives to monthly payments are:

- Lump-sum Alimony Payment

When discussing alimony payments with their clients, most divorce lawyers forget to mention lump-sum payments. It takes a great deal of professional legal experience to make lump-sum alimony payment work. An experienced divorce lawyer will suggest this option to you and guide you through it if you desire.

Lump-sum alimony payment is taxable to the spouse receiving it, but the same case applies to the monthly alimony payments. For the supporting spouse, a lump-sum payment eliminates the need to pay every month. For the person receiving spousal support, a lump-sum payment removes the need to chase monthly payments and claiming missed payments.

For the supported spouse, monthly payments eliminate the risk of reduced payments later on if the payer's financial situation changes.

The supported spouse must exercise discipline after receiving the lump-sum payment to avoid spending all the money at once. As long as the spouse receiving the alimony is willing to receive a lump-sum payment, and the other spouse can pay the money at once, the lump-sum payment is a great option.

With an experienced lawyer's help, the supported spouse can avoid paying tax on the lump-sum alimony payment. First, the payment should be labeled as a settlement to avoid paying taxes on it. It takes a lot of negotiation and legal experience to avoid paying taxes on the lump-sum alimony payment. This is where a good lawyer comes in.

A lump-sum amount might benefit the spouse receiving the support because they can invest the lump-sum and receive regular interest payments. This investment may not be possible with the monthly alimony payments because the chances are that the supported spouse will spend every penny to meet their needs.

The lump-sum alimony payments are particularly ideal when spouses are aged or nearing retirement age. If the supporting spouse reaches the retirement age, they can retire legally and won't have to continue paying the alimony support. Therefore, most supported spouses prefer a lump-sum payment to monthly payments if the payer is almost retiring.

- Extra Community Property Instead of Spousal Support

Another great alternative to monthly alimony payment is receiving additional community property instead of alimony. In this arrangement, the supported spouse waives their right to receive monthly spousal support. In return, they receive a larger share of community property during divorce proceedings and division of property. For this arrangement to work, the property involved must be of significant value, usually real estate. For instance, the supported spouse may take the other spouse's share in the family home or family land.

Property payment eliminates fights that surround monthly alimony payments. It's a viable option as long as the real estate or other valuable property can be easily divided. Extra community property instead of spousal support simplifies the alimony process.

Property buyouts are rare, but under certain conditions, they are an ideal solution. Some of the leading reasons why many people opt for property buyout as an alternative to monthly alimony payments are:

- Property buyout offers an advantage of complete disentanglement, mostly mainly between couples who are hostile towards each other. It's the best option for a couple that doesn't wish to remain connected financially through the monthly alimony payments.

- Property buyouts offer a finality in alimony issues. In the case of monthly alimony payments, a couple engages in never-ending modifications of alimony payment terms and agreements. However, a property buyout is non-modifiable, and once the supported spouse receives an extra share for the community property, there isn't more room for negotiations. After a property buyout deal, you will no longer have to worry about your spouse taking you to court to amend the alimony deal. However, this benefit doesn't apply in the case of partial property buyout.

- A property buyout as an alternative to monthly alimony payments comes in handy when the supporting spouse doesn't have enough money to pay spousal support but is still obliged to pay. For instance, the higher-earning spouse may not have enough money to make alimony payments after taking a loan. In this case, a property buyout would be the best way to pay spousal support.

- Property buyout offers an advantage over the monthly alimony payments because it's not taxable. The party transferring the property doesn't have to disclose the transfer in their taxes, and neither does the party receiving the property.

Despite the many advantages of property buyout as a way of paying spousal support, it doesn't come without risks. Unlike the monthly alimony payments that leave room for negotiation and modification, property buyout doesn't leave any negotiation room. For instance, if the supported spouse remarries, the monthly alimony payments may be reduced or even stopped. However, for a property buyout, the settlement is irreversible even if the receiving spouse remarries.

The other risk of property buyout is that the paying spouse might release a significant percentage of communal property and remain with few properties. At times, the property may not be enough to cover the entire spousal support payment. This means that the paying spouse would have to release their share of a property and still make some out of pocket payments. This risk is rare, but it's still a risk.

- Fixed Monthly Spousal Support/ Alimony

Fixed monthly alimony provides a great way to avoid the uncertainties and issues surrounding regular monthly alimony payments. This payment option still involves a monthly payment schedule. However, spousal support is a fixed amount that can't be adjusted even if the spouse's financial situation changes. This gives the payer certainty of the amount they will pay every month. The supported spouse also benefits from the fixed alimony payment because they will have a steady monthly income source from the supporting spouse.

- Alimony Trust

An alimony trust is explained under the estate and trust law. The sole objective of an alimony trust is to provide financial support in case of divorce. Just like a standard trust, an alimony trust has agreements between the two spouses. A neutral third party expert serves as an intermediary to ensure that asset management is as per the couple's agreement. The supporting spouse adds income-earning investments and stocks into the trust. On the other hand, the supported spouse is the trust's beneficiary. In addition to being an intermediary, the neutral third party serves as an advisor guiding the spouse on their legal and financial obligations to each other.

After the alimony trust activation, the receiving spouse will receive all income generated from the trust's property and assets. The period for which the supported spouse will receive the alimony payment will depend on the alimony trust agreement. If the recipient spouse dies or the entitlement period expires, there are guidelines for handling the remaining property. For instance, new trusts can be formed if the divorced couple had children together. The assets could also be returned to the supporting spouse or used for charity purposes.

Recent Tax Laws Changes and Their Impact on Alimony Payments

Previously the supporting spouse would deduct the monthly alimony payments from their monthly taxable income. The supported spouse would then pay taxes on the alimony payments received. However, effective January 1, 2019, the supporting spouse is the one who pays tax on the alimony amount and not the supported spouse. This means that the supported spouse receives a lesser amount because they receive the alimony money less the applicable tax.

The law eliminates the payer's ability to list spousal support as a deductible expense on federal income taxes. Under the new law, alimony recipients no longer have to report the alimony payments as taxable income. The new tax laws resulted from the receiving spouses' failure to report the alimony income for taxation. For a long time, the state had been losing tax income on alimony money due to the non-reporting by the involved parties.

How did the new law affect the alternative alimony payment options? The new law has caused an increase in the popularity of alternative alimony payment methods due to the decrease of the benefit of monthly alimony payments. The old tax rules apply to all divorces concluded by the end of December 2018. However, the new rule applied to divorce cases concluded from the beginning of January 2019.

After the passage of the new tax laws, many couples in California changed their divorce plans. Some couples changed their alimony demands while others proceeded with divorce with the help of their divorce lawyers. Many couples in California rushed to complete their divorces before the December 31, 2018 deadline.

Alimony is no longer the ideal type of payment structure after the Tax Cut, and Jobs Act took effect. Many couples are opting for one-time alimony payments instead of monthly payments. Lump-sum payment helps to alleviate the tension among many couples and helps them save on taxes. An alternative to conventional alimony payment could save you or your spouse a substantial amount of money during tax time.

Determining the Alternative Alimony Payment Amount

It's essential to make an accurate calculation of how much the monthly alimony payments would have amounted to. This will help you to determine the value of a no-time or alternative alimony payment. It takes a lot of expertise and experience to reasonably calculate an alternative alimony payment to the parties involved. An experienced divorce lawyer will know how to arrive at realistic and reasonable alimony amounts. A lawyer will help you predict a settlement amount that closely matches the consolidated monthly alimony payments you would have paid to the recipient.

Alimony payments are not permanent and rarely exceed ten years. The duration of alimony payments differs depending on the time the supported spouse requires to become self-sufficient and adjust to single life. Other factors that determine the duration of alimony payments include the period for which a couple has been married and whether the supported spouse has a disability or a significant health condition.

Find a Los Angeles Divorce Lawyer Near Me

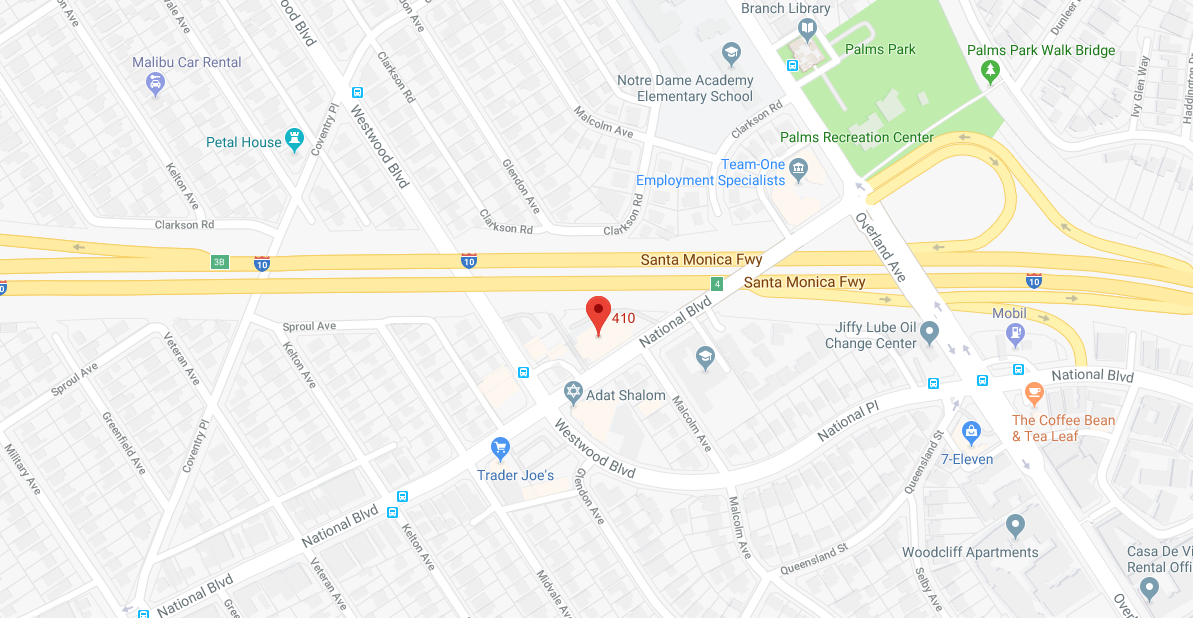

California spousal support laws are complicated and could even be more complicated when seeking alternative ways of paying spousal support. Even if monthly alimony payments are common, they may not work for all couples. If you seek better alternatives to monthly alimony payments, Los Angeles Divorce Lawyer is here to assist. Contact us at 310-695-5212 and speak to one of our attorneys.