The end of a marriage is an unfortunate incident for any individual and family at large. For most married couples, it is usually a difficult procedure that is of concern in many ways. Some of the procedures involved can be uncomplicated and moderately civilized, whereas others are time-consuming due to the elements of divorce such as alimony and child support. In the state of California, the alimony law is considered especially complex, since each decision on the alimony case will be determined by various factors. Most of the courts that handle such cases usually have various factors that need to be considered when deciding whether spousal support is to be paid and if so, what that amount would be. In the following sections we will go over some of the reasons as to why you require a Los Angeles Divorce Lawyer specializing in alimony. The divorce lawyers at our firm have years of experience in handling these types of situations, especially in the courts and will guide you in understanding the law.

How Is Alimony Defined by California Law?

Alimony is also known as ‘spousal support' in the state of California. It is described as the payment from one partner known as the payor to the other partner who is referred to as the supported spouse. It usually takes place after the couple files for separation with their main objective being a divorce. The guiding statute to be followed by the court during the divorce proceedings for spousal support is found under section 4320 of the Family Code. Some of the factors that govern the courts in determining the payable alimony include the following:

a) Purpose

The main intent of alimony in the state of California is to help a given spouse make their ends meet and usually for a specified period of time. The period is usually specified to the spouse so they can be self-sufficient for themselves later on. Section 4320 of the Family Code further states that the involved party should be able to maintain their standards of living that they were used to during their marriage.

The judge, however, has to take into account other factors such as the marketable skills of the partner being supported. Additionally, the code states that it is only for a reasonable period of time, which naturally relates to two (2) years of marriage to one (1) year of alimony. Nevertheless, this does not stop the court from award the alimony in the various time range, either shorter or longer. If the marriage lasted more than ten (10) years, the court will have the ability to award the alimony permanently.

b) The Earning Potential of Both Spouses

The California judge will heavily weigh on this as one of the most important factors of the amount in earning the spouses owns or gets. The earning ability after getting the training or schooling should be sufficient to support both the payer and the supported spouse to live the same life they lived while there were married. The judge also has the ability not to order the alimony, with the supporting factor being how much extra amount of money that is needed to meet the same standard of living.

c) Custody Aspects

Custody is also an important factor in the alimony hearing, predominantly when there are children involved. The courts are hesitant to force a working spouse to work longer hours to help support the children.

d) The Input to the Matrimonial Income

The California law states that it is a community property state. The influence of the community property law expresses that both the spouses have an equal share (50%) in any property or item acquired during their marriage. This goes for income as well. Consequently, the spouses have the right to have the same standard of living they had during their marriage. This is despite the fact that one of the spouses did not work but their contribution to the marriage was in other ways, such as raising children.

e) Domestic Violence

The California courts identify issues on domestic violence in the alimony statutes. In the case that the crime was documented by the injured partner by making a police report or the abusive partner was sentenced with the offense, the court will consider it in the support verdict. In certain situations, if the spouse committed the crime either through physical or emotional means, the judge will likely forbid them from collecting the alimony. In case the support order was placed, the actual amount would be decreased or excluded permanently.

Though factors are not limited, there are other factors that are found in the statutes that will have an influence on the court's decision.

During the divorce proceeding, the judge may order different types of alimony, which depend on the stage of the divorce proceedings. Under the family code section 4320, the judge has the ability to order any of them in accordance with the situation. But first, you need to understand that there are two reasons for asking the judge for spousal support;

- Divorce, annulment or having a legal separation, in this case, it usually is divorce.

- There was documented domestic violence and a judge ordered a restraining order.

In this situation, the case involves divorce of the spouses. So first understanding the process of the divorce will determine the alimony to be awarded.

The Dissolution of the Marriage

For a normal dissolution, one of the spouses, referred to as the petitioner, in this case, will appeal for dissolution by filing a petition to the court clerk. The second partner will be known as a respondent. The petition should be from their respective counties, which includes even the respondents' county. Additionally, if the respondent desires to file a response, they too can file with the county clerk. You and your spouse will exchange both your financial documents which reflect the financial standing of both parties and avoids a ‘who owes who’ situation.

The court will then proceed to the discovery process, allowing the two partners to discuss a way in which they can split their property, this should be fair and agreeable by both you and your spouse. If the agreement has been finalized, both the spouses will be handed a signed judgment by the judge. The condition of that judgment from courts will come to be the terms of the divorce. With a normal dissolution, the waiting period is usually six (6) months before the finalizing of the judgment.

If the couple chooses to use other means of agreeing to the terms of the divorce other than the courts, they will be required to use informal negotiations and alternative dispute resolving procedures such as mediation and arbitration. If they cannot agree on the terms of their dispute, you will face a court to resolve those issues. The process is usually more time demanding and costly, so it is advised that the spouses should reach an agreement outside of court. During this period of dissolution and decree, there are various alimonies the judge can order, both after or before the end of the divorce proceedings.

Types of Alimony

Under section 4320 of the family code, the law describes the various types of alimony a judge can mandate, each with its own clause.

Temporary Alimony

This type of alimony is under section 3600 of the family code of California. It gives the ability to the court to order spousal support to the other spouse during the divorce proceedings. That is until the court orders permanent alimony. The reason why it is referred to as temporary is that it is meant to provide short-term financial support to the lower-earning spouse during the proceedings. The factors that weigh in the calculations of the temporary alimony are explicit elements, such as; insurance deductions and spouses’ incomes just to mention a few. The courts compute the temporary alimony using specified software programs that give an automatic figure, based on the factors mentioned. There are different softwares used by various judges but the usually conclude to the same figure.

Reimbursement Alimony

This alimony is applicable mainly for the compensation one partner for the expenses that the former partner may have paid on behalf of the latter. An example of this situation is when one of the spouses is studying while the other is supporting them financially. In this situation, the courts will mandate the spouse being supported to pay the reimbursement alimony to the other spouse. Normally, as the studies and divorce time increases, the judge will likely not order the compensation payments. Instead, the spouse will be given a portion of the worth of the degree during the sharing of their marital property. Most of the professional practices who fall in this category include doctors, accountants, and attorneys. Moreover, the judge also has the ability to order the payment of the reimbursement alimony as a reasonable lump sum payment, though this is usually paid over a given time period.

Permanent Alimony

The long-term support that is the amount paid by the higher earning partner to the lower earning partner after the ending of the divorce proceeding, it is paid on a recursive basis such as a monthly basis. The question now is how long will the permanent alimony last? The word permanent is usually a contradiction. There are a few situations where the alimony will continue permanently. For those marriages that are under ten years, the support will last for half that length. The marriage, in this case, is the date of the wedding or marriage to the day of separation. For example, if your marriage was eight years, the supported spouse will receive support for around four years.

If the marriage was brief, a time period of one year, then the support would last six months, the alimony payments will have been met through temporary support payments. Some circumstances have no hard-and-fast rule that would be used to figure out how long the support would last. If the marriage lasted over ten years, there are many factors the judge needs to weigh for the supported spouse. Usually, the judge will set the standard of living to that of their marriage, until the spouse becomes self-sufficient.

Rehabilitative alimony

The support is a payment made by the payor to the supported spouse until they get a job, training, or education to have a larger employment options. The support is valid for a given period of time and will be terminated when that spouse can support themselves, generally when they are able to get back to work, or when the spouse who was unskilled develops skills that can earn an acceptable amount of income. Some of the courts will specify the time the payment of this support will be paid, where the courts regularly review the situations of the other half and adjust the order.

Lump-sum alimony

This type of support is ordered by the judge instead of property settlement or if the supporting spouse decides to pay the whole amount of support at one time lieu of every recursive period of time that was ordered by the court.

After the divorce is finalized, the supporting spouse will have to follow as ordered in the settlement agreement. This is until one of the spouse requests modifying or terminating the support.

Modifying or Terminating Spousal Support.

Any of the spouses can appeal the time or amount of the support to be changed. The conditions usually being that the original settlement agreement that orders the support did not contain any semantics that the support is ‘non- modifiable'. There are mainly two ways of handling this situation; the first one is that both you and your spouse come to an agreement to modify the time or amount of support. If this is the case, you and your spouse will have a written agreement that will be handed to the judge, who will make it an official court order.

The second choice is that both of you do not agree with the agreement. You will then have to face the court where the spouse wanting the alteration will file a motion with the court and show the reason as to why they want the court order modified. This is referred to as the material change of circumstances. There are various reasons for this change of situation, including; job loss or the supporting spouse earnings have reduced drastically by no fault of their own. The court will find a reasonable way of altering spousal support.

The termination of the support can also be ordered if you terminate the responsibility to pay the alimony. That is if the situation is relevant to the state of California and it warrants termination. Nevertheless, if the order between you and your spouse or the court was prepared ‘non-terminable', you will not be able to terminate it until the time it was set to end. The responsibilities will be terminated automatically if the partner passes away. If that happens, the spouse will no longer be required to pay alimony.

Is Spousal Support Tax Deductible in The State of California?

If both the partners have to file different tax returns, spousal support will be tax deductible. The partner paying support has the ability to deduct the required amount of alimony. But if the alimony is shared, there will be no tax deductions.

Cases Related to Alimony

-

Palimony

Though, not in the California law, palimony has been permitted since the 1976 verdict by the supreme court of California. The appeal for spousal support is established on premarital cohabitation and are not forwarded to the family courts since they are not part of the divorce proceedings. However, they are filed as a general civil action, generally in unification with a breach of contract or disguised partnership claims, but not limited to those terms.

Outlined under sections 300, 308 and 4330 of the Family Code are the statutes that are related to the formation of a marriage and alimony payments. The three sections of the family code have no direct relation with palimony, but for any palimony contract of two unmarried couples to be enacted, the requirement is that they should be cohabitating with an exchange of domestic services.

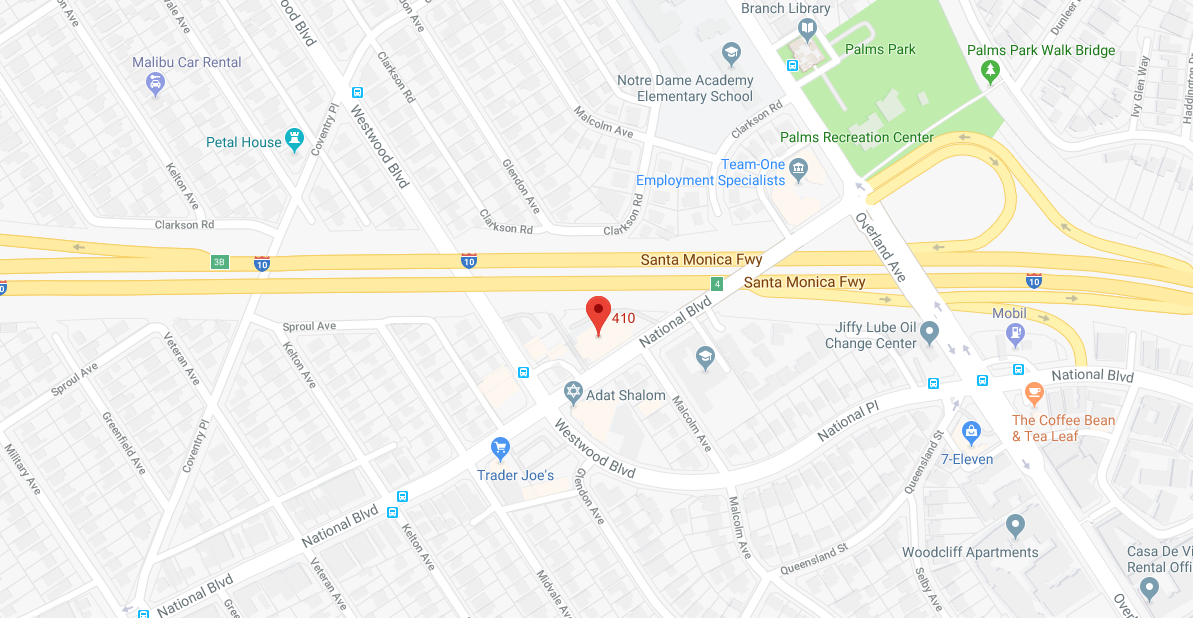

Find Los Angeles Divorce Lawyer Specializing in Alimony Near Me

The law on alimony is usually complex and time-consuming. By having a specialized divorce lawyer argue on your behalf, it could help lower the alimony that you will be required to pay. The Los Angeles Divorce Lawyer has built a reputation for handling these types of cases with utmost importance since alimony judgements can affect you for the long term. Over the years we have developed a deep knowledge of court processes and family law. Call our offices today at 310-695-5212 and discuss your case with us.