Entering a legal marriage means that your spouse’s income and debts are now yours. If one spouse runs up a huge debt, you will be both held accountable. Also, the money you earn in wages and salaries is considered marital property. Unfortunately, money and financial issues are a significant cause of marriage problems

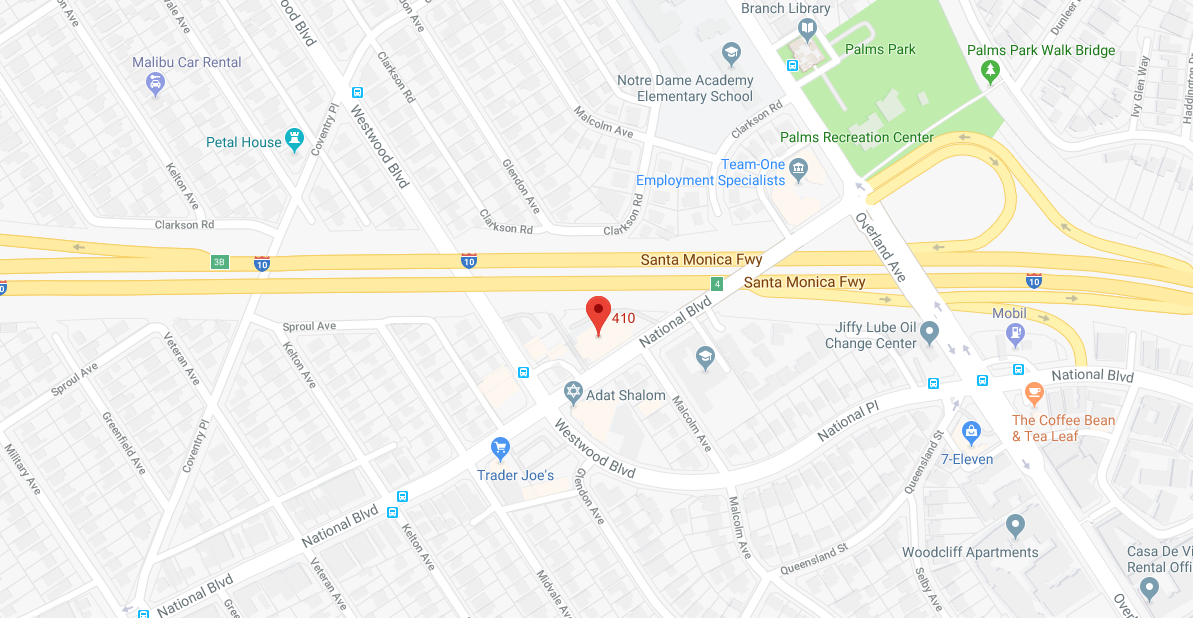

If you experience difficulties in sharing or handling property during a divorce, you might need the services of a mediator who is experienced in divorce matters and marriage law. For couples going through a divorce in the Los Angeles area, we invite you to get in touch with the Los Angeles Divorce Lawyer.

Property Ownership in Marriage

When you plan to enter a marriage commitment, many people want to know what happens to their finances. After a legal marriage, your financial lives are merged, and you may even be responsible for each other’s debts. Since money causes most marital problems, understanding how finances are handled will set you and your partner up for a successful marriage.

Property is any physical asset like vehicles, cars, or other valuable things like bank accounts, businesses, and stock. To understand how property division works after a divorce, it is important to understand how property ownership changes when you enter a marriage:

Community Property

California is a community property state. A marriage or domestic partnership in this State makes people a community. All property and debts acquired during the marriage by one of the parties are considered community property. Therefore, if your spouse accumulates a debt while you are still married, both of you will be responsible for paying it. California Family Code 760 defines community property as all real and personal properties acquired during a marriage.

Community property may include:

- Items purchased using money made by one spouse while still in the marriage

- Separate property that was mixed with community property

- Money earned by either spouse during the marriage

- An inheritance that was deposited in a joint account

- Debts accrued by either spouse

Separate Property

According to the marriage law of California, separate property is property owned by one party before entering the marriage. Separate property also includes gifts or inheritance awarded to one of the parties and property acquired or income earned after separation. When you intend to end a marriage, the date of separation is crucial, and you should record it. This will help you protect the assets you acquired before the marriage.

Any property you buy with income from separate property is considered part of separate property even if you purchased it during the marriage. Sometimes, the community could gain an interest in your separate property under the following circumstances:

- You mix your community and separate property during the marriage

- You transfer ownership of your separate property to the community

- Your separate property was appreciated during the marriage

- The time, service, and skill you used in the separate property during the marriage could create a community property interest in the asset

Commingling of Property

Division of property is not as straightforward as it seems. Most works in the divorce process involve separating the separate property from the community property throughout the marriage. One of the common occurrences is where one party owns a home before the marriage and sells it to pay for a new family home. Although the down payment made is separate property, payment of the mortgage with money earned in the marriage could mix the separate and community property.

Divorce and Property

Divorce terminates a legal partnership between married couples and may require division of property owned in the marriage. Division of assets and property is a huge concern during divorce proceedings. Having permanent and complicated laws will not help the situation. Therefore, guidance from a competent divorce attorney is crucial.

1) Inheritance and Divorce

An inheritance can take place before marriage or during a marriage. Generally, inheritance is not subject to equitable distribution since it is not considered marital property. An inheritance is treated as a separate property belonging to the individual who received it. However, if it is awarded to both parties or deposited in a joint account, it could lose its separate property status. If a property acquired through inheritance is used to benefit marital assets, it will no longer be an exception.

If you enter a marriage with prior wealth acquired through inheritance, the court will determine how to treat it in the event of a divorce. The best approach you can take to protect the assets you own before entering a marriage is by seeking a prenuptial agreement. Although commingling of funds will convert them to marital property, you can keep some of it separate if you prove that you did not intend to share.

Before you enter a marriage, you could agree on how to divide marital property if the marriage ends in a divorce. In the event of a divorce, community property will be divided equally between the spouses. Any property that you owned will remain under your name even after a divorce. However, the following are some exceptions to equal property division:

- One spouse misuses the community property before or during the divorce proceedings are pending.

- One spouse incurred liability from a lawsuit that is not related to or leading to the spousal benefit.

- A spouse incurred educational costs. Even when you enter a marriage, each individual will be responsible for their student loans and have personal liability to them even after a divorce.

- Benefits resulting from a personal injury compensation are considered part of community property if you are still married. However, after a divorce, the benefits will only be awarded to the injured party.

- In situations where the couple had significant debt, division of property is done in the factor of the spouse with relative ability to cover the debt.

2) Who Gets the Family Home after a Divorce?

During the divorce process, property division is one of the most difficult parts. It is difficult to determine what goes to each party after splitting lives that have been combined for many years. If a family home was purchased with money earned within the marriage, it is considered community property.

If it is determined that the home is community property, then there is a complicated process to determine how you and your ex-spouse must share it equally. Sometimes selling the property to share the proceeds may be easier than trying to divide the home. If you have to wait for the property to appreciate and meet a certain price, you must sign an agreement to ensure that you receive your fair share of the home.

If it is difficult for you and your former spouse to agree on the fair splitting of a family home during a divorce, you may need the guidance of a competent divorce attorney. Some of the factors that a court considers when dividing the family home include:

- Agreement between the parties

- Presence of dependent children in the marriage at the time of divorce

- Source of finances with which the home was purchased

- When the home was purchased

In addition to the above factors, child custody may affect the division of a family home. Divorce is a very complicated process, especially when children are involved. During a divorce proceeding, the court will always look out for the interests of the children. The family home often plays a significant role in the children’s lives. The court will factor custody issues into the division of the home. Since the stability of the children is crucial after a divorce, the fate of a family home will be a complicated issue.

When your family home falls under community property, the two primary choices you have are to sell, or one spouse can buy out the other. If you cannot agree between yourselves, the court may have to impose their way. The factors that go into dividing a family home are complicated. Therefore, reaching a divorce attorney may help ensure equitable division.

Property Division After Separation or Death

When a spouse dies, half of the community property will go to the surviving spouse. However, the separate property belonging to the deceased spouse is allocated to the person indicated in their will. The State of California offers the interest of community ownership with survivorship. Under this doctrine, if you hold a title deed to community property and your spouse dies, the ownership of the property can be transferred to you without all the legal proceedings.

A legal separation works the same as a divorce, and the community property is subject to equal division between the parties. Although some economic circumstances could warrant awarding particular assets solely to one spouse, both spouses will end up with half of the community property.

Spousal Support

In many marriages, one spouse earns higher than the other. Sometimes, a spouse could dedicate their time to raising children and the family instead of working. If you forgo a career to take care of the home while your spouse advanced in their career, you may be eligible for spousal support after a divorce. Alimony is aimed at ensuring that both spouses maintain the kind of life in the marriage.

Spousal support is one of the main issues that arise during a divorce. Most issues regarding property in marriage do not address alimony. If you need alimony to stay afloat, you should fight for the full amount with the guidance of a divorce attorney. Some of the factors that could affect spousal support include:

- The standard of living you enjoyed during the marriage

- The contributions of each spouse towards childcare

- The ability of the receiving spouse to go back to school gain skills and seek employment

- Division of property and assets after the divorce

- Length of the marriage

Avoiding Marriage Money Problems

While financial issues result at the end of many marriages, they can be avoided. Although conversations about money may be uncomfortable, they are important at the beginning of a marriage. You should sit down with your new partner and discuss issues that could arise and how to go about them. The following are some of the ways through which you can avoid money problems in a marriage:

Set Reasonable expectations

Setting expectations is one of the reasons why money issues result in divorce. When the lifestyle expectations you set do not materialize, you may face marital problems that could and the marriage. At the beginning of a marriage, you need to discuss these issues:

- Expenses that each individual should cover and the shared expenses

- Whether or not you should create a joint account

- How debts that enter in the marriage will be handled

- The amount that each spouse must contribute to covering the expenses

Make Future Plans

It can be difficult to predict the future when entering a marriage. However, this should not prevent you from planning how to go about it. You should set financial goals that you need to meet and how you will work towards meeting them. As your financial circumstances change, you can revisit your goals. Some of the topics that you could consider when planning for your financial future include purchasing a home, having children, saving for college for potential kids, among others.

Make a Budget

Making a budget helps you account for all the money that comes in and out of the marriage. Also, it helps you live within your means and avoid the accumulation of debt. Some of the basics that you must include in a budget are:

- Income which may include salaries, income from property and businesses

- Assets

- Debts such as mortgage loans and credit

- Expenditure such as rent, utility food, and entertainment

For a young couple planning for their financial life, it may be a challenging experience. Therefore, you need to be honest with each other and be able to compromise your expectations. This will help financial issues that could end the marriage.

Prenuptial Agreement in California

Money and property issues contribute significantly to disputes in a marriage, and when you fail to handle them in the right way could result in separation or divorce. One of the ways through which you can avoid financial problems in a marriage is by entering a prenuptial agreement. A premarital agreement establishes the financial rights of each spouse in case of a divorce. Although divorce is not always in your mind at the beginning of a marriage, about half of all marriages in America result in a divorce. If you are financially established before a marriage drafting a prenuptial agreement may be a wise choice.

The California Uniform Premarital Agreement Act regulates the rules regarding premarital agreements. Some of the properties that could be included in a penal include real estate, financial interests, and present and future earnings. The requirements you must meet to create a valid premarital agreement include:

- A written contract

- Legal terms within the prenup

- Signature from both parties. The signing of a prenup must be voluntary.

- Signature from a notary

- At least one week to seek legal guidance before signing the document

If you decide to enter a premarital agreement, you must enlist the guidance of a competent attorney. There are several reasons one would opt to sign a prenuptial agreement before entering the marriage. All are centered on protecting your financial interests if the marriage ends in divorce. A prenup could be used to:

- Protects the assets you owned before entering the marriage

- Protect you from the responsibility of the other person debts

- Determine how property will be divided after the death of one partner

- Clarify financial responsibility of the parties

- Simplify division of property in the event of a divorce

Entering a premarital agreement should not be taken lightly since the mention of this agreement indicates an anticipated end of the marriage. Before entering a prenuptial agreement, you need to speak to an attorney. The thought of a prenup could create distrust. Also, it is crucial to understand that a prenuptial agreement will not address child support and alimony issues. Therefore, if the marriage ends, you must go to court to deal with these issues.

Sometimes, a prenuptial agreement may be considered invalid. If one of the spouses was coerced to tricked to sign the agreement or did not have individual legal counsel, the measures stipulated in the agreement are not valid.

Find a Los Angeles Divorce Lawyer Near Me

Money is one of the most common causes of arguments between married couples. Discussing financial matters can be tough before you get married. However, failing to plan for the future and make necessary arrangements for your financial issues could contribute to the end of a marriage. In California, the property in a marriage is classified into separate and community property. Community property is owned jointly between the spouses and must be divided equally if the marriage ends in divorce.

On the other hand, separate property is assets you purchased before the marriage and are not divided after a divorce. Understanding the law on marriage money and property will help you avoid financial problems during the marriage or in case of a divorce. If you have financial issues relating to the marriage or divorce, it would be wise to seek legal guidance. If you are in Los Angeles, we invite you to contact Los Angeles Divorce Lawyer today at 310-695-5212.