The divorce process raises many questions for parties involved, including the entitlement, if any, to provisions made in wills. Subsequently, many divorcing couples will seek guidance from a divorce attorney on the best approaches to take when concluding their divorce. In doing so, they understand the effects of their legal separation on any previously formed will.

At Los Angeles Divorce lawyer, you will access excellent legal services from some of the best practitioners available. Our goal is to ensure that all our clients benefit from our informative and solution-based assistance. Over the years in practice, we have helped hundreds of clients seeking advice on the effects of divorce on wills in Los Angeles, California. Therefore, you can expect well-researched and thorough responses to help you address the issue.

Instances Where a Will is Revocable

A will is a legally recognized document that allows a party to issue express instructions on property distribution to named beneficiaries upon death. The will-maker is the testator, and they have discretion over the type of provisions to include in the will.

Although a well-drafted will is applicable without the court’s intervention, several instances may lead to its revocation. You want to understand the various scenarios to empower you with the necessary tools in revoking the will. The four main instances are:

Revocation After a Will is Destroyed

Wills might face destruction if the storage opted for proves non-effective or prone to access from unauthorized parties. For example, if you stored the will in a soft copy, a malicious third party may access it and destroy it to prevent beneficiaries from exercising their claims.

Similarly, physical storage may expose the document to physical deterioration or improper handling by third parties. Consequently, executors may lack a solid reference point when distributing property.

Revocation After a Testator Undertakes Subsequent Writing

As mentioned, the testator holds complete discretion over the content in a will, including the parties entitled to benefit from the estate. The discretion further applies where the testator wishes to disregard all previous provisions and produce a new version of the will. Doing so gives rise to a provision called further writing, whereby new clauses are included.

It is noteworthy that subsequent writing does not have to revoke all previous provisions issued in the original will. Sometimes, the testator may choose only to alter specific clauses or introduce new provisions. Despite this, some additions may contradict the original instructions, meaning that the will is revoked entirely. If so, the testator should make fresh orders to avoid creating contradictory guidelines.

Revocation by Ending a Domestic Relationship

Domestic relationships form the basis for many will and probate provisions, as similar interests bind the two parties. However, terminating a domestic relationship may significantly affect your entitlement to remain as a beneficiary in the testator’s will.

Due to this, the will may be revoked to give the testator a chance to revise the contents and change the beneficiaries listed in the document. Therefore, the previous will ceases to exist and is replaced by a new document version that applies without prejudice.

When a Marriage is Dissolved

Finally, a divorce will invoke revocation because the previously mentioned spouse loses their entitlement to benefit from the estate when the divorce applies. This guideline ensures that divorced parties do not take advantage of their past relationship to exploit each other and wrongfully gain under the will.

You should ensure that a court decree is readily available before you consider revocation as a subsequent step to the divorce, as it forms the basis for your revocation. Having legal backing for your decision will prevent your former spouse from claiming from your estate in the future, giving rise to potential disputes.

The Probate Code allows a will to be revoked after divorce under subsection 6122, allowing a divorced testator to review their will and introduce new provisions that exclude the former spouse.

What Happens During a Divorce

When a married couple decides to separate and legally end their marriage, they need to consider different factors. The primary considerations are distributing property and altering any documentation providing privileges to spouses. This is because they want to end their marriage, so the rights and entitlements should cease to apply to all involved parties.

The divorce process begins with a petition filed to the court, whereby the petitioner discloses their intention to seek marriage dissolution. You should note that California is a ‘no-fault state,’ meaning that the petitioner does not need to provide reasons for seeking to end the marriage.

While the provisions are liberal for the party seeking a divorce, you may be taken by surprise in some instances, meaning that you have limited time and resources to determine the next step. Nevertheless, you will only need to make court appearances and sign documents to allow for a decree production.

Distribution of Matrimonial Property

Before concluding the divorce, you want to ensure that you and your spouse agree on technical provisions like property distribution. Doing so prevents the possibility of any disparities from arising, especially where ownership is unclear between parties.

The directives applicable in California allow parties to distribute community property equally between themselves. This type of property includes anything bought and maintained communally, including the family home, vehicles, and investment property, among others.

On the other hand, property bought or invested individually remains under the individual property owner’s title. Hence, you will fully retain all possessions classified under this category unless you provide full consent to have them divided between you and your spouse.

Most property owned individually will have been acquired before parties were legally married, even if they were together at the time. This is because legally binding documents and contracts only recognize the signatory’s name as the rightful owner.

This mandate extends to any property listed under a person’s will because they have the sole mandate to dictate property distribution. Hence, if the testator undergoes a divorce, they may decide to revoke their will as it contains provisions for a party who is no longer partisan to the benefits. Alternatively, your attorney can suggest alternatives to consider in the wills and probate section for your benefit.

The Effects of Divorce on Wills and Probate

Once the court issues a divorce decree, they are officially separated and become two individual entities. Various legal repercussions follow the determination, as the parties acting separately will require independence on various aspects.

Subsequently, a party earlier listed in the will document of their former spouse is treated as having died before the testator. In practice, the assumption serves to fully remove their rights and entitlements under probate law, as divorce separates them from the other party.

Hence, the primary effect of divorce on wills and probate is the perpetual exclusion of your rights as a beneficiary unless you decide to remarry the former spouse. Even then, the testator holds discretion on the subject matter to include in the document.

Difference Between Legal Separation and Divorce in Wills and Probate

While legal separations are often the first step towards obtaining a divorce decree, they provide different outcomes in will and probate matters. Thus, a legally separated spouse retains their entitlement under the other spouse’s will until the divorce is finalized in court.

This is because legally separated parties are still viewed as married in California, so the rights of married people remain relevant to additional considerations. Furthermore, legal separation only enables parties undergoing unbearable circumstances to distance themselves from their spouses until they reach a viable solution.

Hence, if a separated spouse dies testament and has not changed the will's contents, their spouse can rightfully exercise their rights and recover from the estate. However, if the court was in the process of producing a decree for the spouse, interested parties can raise a dispute and have the matter deliberated for a fair course of action.

Entitlements in the Will Revoked After a Divorce

You also want to understand the specified entitlements lost after a couple of divorces to help you know the best route to enforce your rights. Firstly, your appointment as a fiduciary party in the will ceases to apply after a divorce, as your interest in their property is limited. Hence, you do not have the mandate to raise any recommendations issued when parties act in that capacity.

Additionally, any power of appointment made to you under the will be revoked, so you cannot appoint trustees to act in the interest of conserving the estate. Subsequently, the court may appoint its trustees if no other solution is applicable at the time.

Restrictions on Transfers Excluded from Probate

Furthermore, marriage dissolution also applies to other benefits and property beyond what is specified in the will. Although the probate rules do not apply, parties can rightfully invoke their rights to exclude the former spouse from protecting their property and avoiding dealing with other disputes. The following are the main types of transfers that revoke a former spouse from raising claims:

- Any employee benefits provided for the former spouse

- Pension agreements

- Trusts established in the former spouse’s interest

- Retirement plans and insurance policy returns

- Compensation benefits after winning a court case

- Any property transferred through the conveyancing

Despite the revocation of any beneficiary relationship, you can contest your position by providing justifications for your continued inclusion as a beneficiary. Your argument should be legally structured to avoid painting you in a negative light.

For example, if you and your former spouse contributed equally to the purchase of property transferred through conveyance, you can present evidence of your contributions for inclusion. The evidential sources include bank deposits and transfers or any documentation imposing your financial responsibility, among others.

Nevertheless, you should remember that the court also considers non-monetary contributions, especially if you lacked a source of conventional monetary income. The inclusion serves as an equitable provision to ensure that parties with limited opportunities can still consider their non-financial value.

Instances Where the Rules of Wills and Probate Do Not Apply After Divorce

Although all divorced parties lose their entitlements and beneficial interests in a will after the marriage dissolution, exceptional circumstances may apply to prevent their exclusion. This often means that the law applicable to divorced parties does not apply to their situations or that probate law had not evolved to include divorces as a consideration when revoking a will.

The two main instances where a divorced party is still entitled to the former spouse’s will provisions are:

Where Parties Were Married Before 1/1/1985

Notably, the law is constantly evolving to accommodate other plights for the citizens it affects. Thus, legal provisions on wills and probate before 1985 included former spouses as parties entitled under a testator’s will.

Although the system posed a potential risk of exploitation between ex-spouses, the reformed law does not apply for parties married before 1985, as it would create redundancy to pre-existing laws that were functional.

Therefore, a divorced spouse who was married before the final year is still considered a valid beneficiary in the will. As a result, their entitlement to the estate should be uncontested unless the disputing party can present credible justifications contrary to the court orders.

For example, if evidence shows that the couple was not legally married, they will lose their ability to claim from the testator’s estate. This will also apply where a court ruled that the marriage was conducted illegally, meaning that it was never valid at the time of its existence.

When Parties Remarry

Divorced parties are free to remarry at will to exercise their constitutional rights and freedom. Therefore, remarriage is valid under the law and allows the previously divorced party to be reinstated as a beneficiary in a will document. Additional factors to consider in remarriages are discussed below.

What Happens After a Divorced Couple Remarried

After a decree of marriage dissolution is produced in court, it becomes applicable to both parties and can be enforced as a point of reference after six months. However, the decree does not prohibit a couple from reuniting if they wish, as the law encourages the family institution to all citizens.

Subsequently, any couple who wishes to reunite and remarry after divorce can request legal guidance on having the decree revoked. Upon following the necessary guidelines, you can pursue a new marriage declaration issued officially as a certificate.

You should note that the effects of remarriage on wills and probate will change based on the newly reinstated union of the couple. As a result, the prohibitions to being a beneficiary in one party’s will are lifted, and you will be named as a beneficiary as it was before the initial divorce.

Nevertheless, you should note that the testator holds the ultimate discretion when drafting a will. Thus, they may exclude any party in the document, including their spouse. Their decision is non-contestable and may not be changed under persuasion or applications for review.

Hence, you want to hold discussions with your newly reunited significant other to ensure that they are still keen on including you in their will upon remarrying.

Divorce Cases Involving Intestacy

Although many persons prefer to document their will for ease of reference during property distribution, you should note that some parties may choose to remain intestate. This means that while they own property worth distributing among beneficiaries upon death, they do not codify their beneficiaries and trustees.

Usually, legal provisions dictate that the property owned by a party who died testament automatically transfers to their spouse upon death. This is in line with the priority given to a spouse under family law, as they are viewed as having common interests with their significant other.

Therefore, if a party divorces while still intestate, the spouse’s entitlement to any benefits or property ceases automatically. The law will no longer recognize the parties as legally married, meaning that the divorced party no longer has a claim to make.

Subsequently, if the property owner dies after divorce, the benefits or property transfer to the next available family, including the children. A couple does not have children, extended family members like the person’s parents and siblings are then considered.

Contact a Divorce Lawyer Near Me

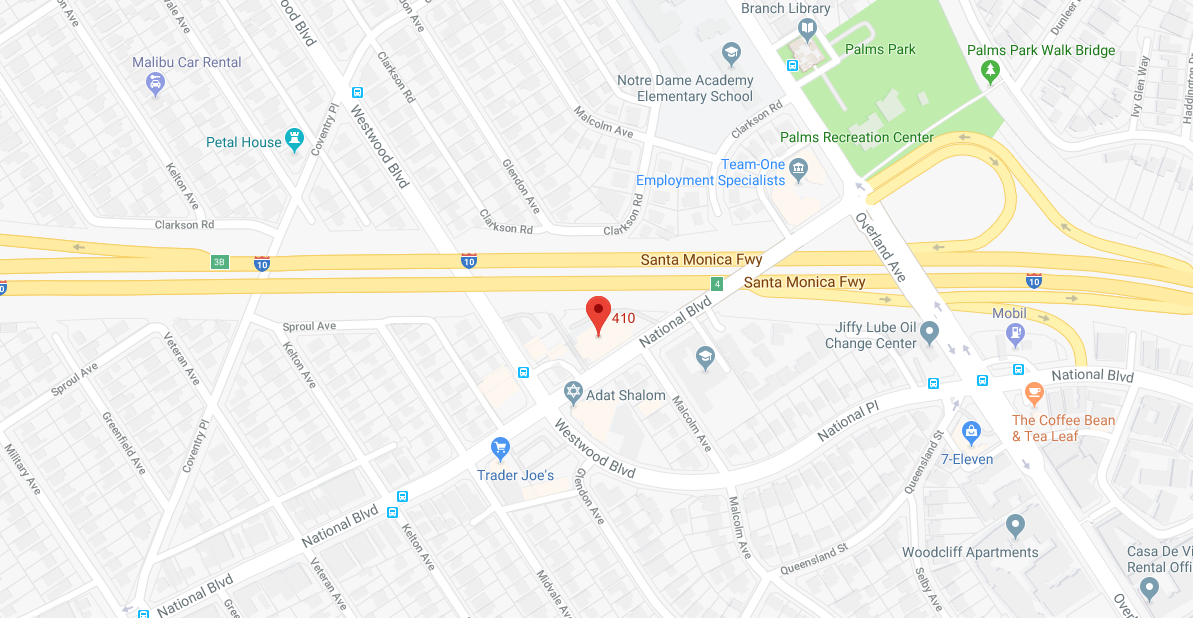

Doubtless, involvement in a legal separation requires you to understand different legal matters like wills and probate. The subject matter is especially relevant if you or your spouse had created a will that previously included them, but that no longer applies to them. With your divorce attorney’s assistance, you can evaluate the various solutions to the wills and probate questions for your benefit. Further, your lawyer will provide support throughout the divorce process to ensure that marital property is distributed equitably. With Los Angeles Divorce Lawyer, you will enjoy high-quality services from experienced attorneys with a wealth of knowledge in divorces involving wills and probate. Our team has handled numerous cases for clients seeking to revoke or change their will after divorce in Los Angeles, California. For more information on our services, contact us today at 310-695-5212.