When it comes to a divorce, you are not only breaking up romantically but also financially with your partner. The California laws and guidelines used in determining how property is to be divided in case of divorce are quite complex. How property gets divided and what assets get to be shared varies depending on the type of property in question. Complex property like pension funds, stocks, and business assets usually create disagreements when couples are determining how they should be divided.

At Los Angeles Divorce Lawyer, we are conversant with the legal requirements and the court processes involved in the division of property in divorce proceedings in Los Angeles. Our lawyers may help you make sure that all of your property, even the complex one, is fairly divided between you and your spouse in settlement of your divorce. If you are in the process of getting divorced and need help, call us as soon as possible. We boast several years of experience assisting our clients in retaining or obtaining their deserved portion of the community property. This article focuses on the legal issues involved in property division, as well as how complex property is divided in a divorce case.

California Community (Marital) Property Law

California is among the states in the United States that apply community property law and not equitable distribution law in case of a divorce. As per the equitable distribution law, the assets that a married couple acquires during their marital union belong to the person that earned them, except in unusual conditions. And in case of a divorce proceeding, marital property will be divided equitably depending on different aspects.

On the contrary, under community property law, marital property is divided 50/50 irrespective of mitigating factors. This implies that even if it was one spouse working for the entire marital union period, both spouses own the money earned in equal amounts. Equal ownership stretches to the debts that are incurred in community assets too, which makes both spouses be equally responsible for debts. This would be the case even if one of the spouses did not know that the debts existed.

Apart from child custody, division of property may be another most significant cause of disagreement between couples that are getting a divorce. Each of the spouses is probably concerned about the way the marital property will be shared and whether or not they’ll receive the number of assets they feel that they qualify to get. This is particularly true in case one of the spouses has sworn to leave his/her partner in poverty, merely to hurt them deliberately.

Several factors determine the ultimate awarding of property. For instance, the court might consider factors like the period of marriage, the income of every spouse, etc., in deciding whether or not to adjust away from the strict 50/50 community property division rule. However, having an experienced family law lawyer fighting for you throughout the entire divorce process might be the most critical step you can take to secure your future. In situations where you think your partner was involved in asset dissipation before the divorce proceedings, your lawyer could hire a forensic accountant who will help to prove that you are eligible for a higher portion of the asset distribution.

Marital v. Separate Property

The presumption under community property law is that the entire property that’s acquired in the course of a marital union by either partner (while residing in California) is community assets, including personal property and real estate. The location of the real estate, even if it’s outside California, isn’t relevant, provided the partners retain a residence in California State. In specific situations, settlement acquired from personal injury lawsuits can also be treated as community property.

An exception to marital property law for assets obtained jointly in the course of the union is a post- or prenuptial agreement that specifies the assets to be separate. Regardless of the presumptions related to community property law outlined under Family Code 760 and 761 of California, you can still move to court to try and disprove a specific asset as marital property. But, for you to do this successfully, the court will need you to prove by a preponderance of the evidence that the property in question is indeed not a community asset. Additional facts concerning the distribution of community property in California include:

- Once a divorce petition is filed, restrictions will be put in place to limit asset transactions. The limitations include borrowing against community property.

- Neither spouse can lawfully give away or sell a marital property without the other spouse’s knowledge or agreement.

- Allocation of property by the judge can be prevented if only a legally-binding written agreement; for instance, a prenup agreement is in place.

- Whereas married couples are generally permitted to have control over their separate assets independently of their partner, once a legal separation or divorce is effected, temporary restrictions are put in place. These restrictions prevent even the selling of real estate that’s separately-owned.

You may be wondering what comprises separate assets. Separately-owned assets are not included in the division of property in case of a divorce. Under California State laws, the following are classified as separately- owned assets:

- The property that either spouse acquired before the marital union.

- Property that either spouse inherited or was given as a present after or before the marriage.

- Profit from the assets that either spouse acquired before the marriage (there are certain exceptions, however).

- Profit from the assets that either spouse inherited or was given as a present after/before the marital union.

- Income earned when living apart & separately.

- Wealth or earnings acquired after the couples have undergone legal separation.

Any other property that’s not included in the above listing, including money and valuable things acquired in the course of the marriage are community assets unless stipulated otherwise in a post- or prenuptial agreement. This means that bonds, pension funds, stocks, and even real estate are classified as community assets and have to be divided equally between spouses.

When Separate Assets can be Turned into Marital Property

With permission from both partners, separate property can be changed to community property, and vice versa. This can be done via the recording of a title change called transmutation. Another instance of changing the separate property to marital assets would be in case a husband had a Ferrari before entering the marriage and then added the name of his wife to the title in the course of their marriage.

A transmutation qualifies as valid if it is in writing. In case the transmutation affects another party, for instance, a creditor, the creditor has to be informed of the changes in ownership. Debts and assets are identified and investigated in the course of a divorce case and classified as separate or community property.

Agreements on Property Settlements

If there aren’t any children from a marriage, that’s no issues of child custody and support; then, an uncomplicated settlement can solve property division problems arising in the divorce process. Spouses can reach an agreement by themselves, and the judge prefers that this happens. However, if the spouses fail to agree, the judge will step in and will order that the property be shared in a manner that might not suit any of the spouses.

It’s critical to seek expert legal assistance and advice in drawing up your agreement on property settlement. All relevant assets must be included in the settlement and evaluated correctly. At Los Angeles Divorce Lawyer, our attorneys can access property valuation professionals for every type of asset involved. Also, we understand how California statutes view the distribution of every kind of property.

It’s better to make sure that your settlement agreement is legally formulated from the start instead of struggling to have the approval of the judge because it is considered incomplete or inequitable. Having a lawfully drafted settlement agreement also helps you to avoid future disputes over claims that someone hid marital assets or misinterpreted them as separate assets.

Note that a property settlement agreement can address several issues related to divorce. These issues range from pensions, 401Ks, child support, real estate, to alimony. Formulating the property settlement is a very complicated process that needs extensive legal expertise.

Complex Property Division

In specific divorce cases, there aren’t many community assets to share, or they are all simple, for instance, money in the bank and a few high-priced commodities. Or, it could be that a post- or prenuptial agreement already resolves how each property should be divided. In cases like this, the division of property becomes relatively simple.

However, even though various situations are easy to handle, others can be more complicated. Challenging cases include high profile, high-asset divorces where the assets to be shared are complex, for instance, stocks, pensions, retirement accounts, bonds, large amounts of real estate, investment accounts, business property, and 401(k)s.

Inheritances and gifts are not included in this form of division. Additionally, there are tax-related matters that will be considered based on the way the complex assets are divided. Therefore, it is not a straightforward issue, and you will need an experienced family law attorney to make sure you do not meet any legal obstacles throughout the divorce process. Also, it is usually necessary to work with experts like forensic accountants and business valuators in the property division case of your complex assets.

Keep in mind that it is common for your partner to challenge issues related to high-value, complex assets in the course of a divorce case. There may be issues to do with whether a given property should be counted as marital property, a dispute over a particular asset having been left out of the financial disclosure you issued to your partner, or a disagreement about what’s the correct value of a given property.

Divorces that have divisions of complex property have to be handled particularly carefully, with the assets being evaluated thoroughly. Complex property division can include:

- Valuing stocks

- Splitting a business that’s primarily run by one of the spouses

- Valuing & dividing ranch and commercial real estate

- Valuing a business, especially the family business

- Determining if an inheritance is a separate or marital property

- Splitting corporate partnership property

- Splitting the pension of one of the spouses

- Deciding how divorcing will impact taxes for the involved parties.

- Division of retirement assets, like 401(k)s and IRAs.

- Deciphering post- or prenuptial agreements

- Preparing Qualified Domestic Relations Orders

- Determining child support and spousal support amounts

Valuing Assets During a Divorce in California

When spouses disagree about the worth of a property, it might be obligatory to hire a forensic accountant or real estate appraiser to help in determining the worth of the property. The value of the marital residence or other residences will be determined via a Comparative Market Analysis. This analysis considers comparable homes that have been sold recently or are presently listed for sale in the locality.

Depreciation, appreciation, and residence improvements are also considered during a home valuation. Three methods are commonly used in valuing personal assets. They include:

- Property is evaluated at a price it would cost to have it replaced.

- A market comparison may be applied for assets that are considered collectable or rare, which couldn’t be replaced easily. This method considers the latest sales of resembling assets.

- A skilled appraiser may be hired to determine the future worth of a given investment, for instance, pieces of artwork.

During a business valuation, a qualified forensic accountant considers the following:

- The debts and assets of that business.

- Whether or not the value of the business has increased since marriage.

- The profit the business has made,

- The date of valuation.

Qualified Domestic Relations Order (QDRO)

One aspect of the division of property that’s usually involved and several couples overlook at the start is the splitting of pension payment. Often, a QDRO is included in settlements of asset division and spells out what share of a spouse’s pension money goes to his/her partner and the period that partner will continue receiving the payment.

In the course of the marital union, one partner may have helped the other to acquire a work training, professional license, college degree, or time to earn the cash, while that other partner attended to necessary duties like taking care of the children. If this is the case, the spouse that helped out is, as per California statute, usually eligible for a portion of the involved pension amount. He or she becomes a co-beneficiary of that pension plan.

However, the spouse that’s getting a part of his/her partner’s pension might need to report the amount of money he/she is getting and pay tax on it. There’s also the choice to have the pension money received deposited into an IRA account or any other retirement account, thus delaying the payment of any form of tax on it. A procedure like this permits whichever party that’s receiving the money to manage it while it’s in their account.

Note that it’s only until you obtain a QDRO that’s court-approved in your property settlement agreement will you receive the pension money. Failure to which, you may still have the pension money that belongs to you be given to your ex-partner. But, you may yet be required to pay tax on it anyway. Therefore, a Qualified Domestic Relations Order is very critical to the partner that owns a pension fund and the one who doesn’t as well.

If you’re the partner that’ll receive funds from your ex’s pension and you do not want to deposit it in an IRA, you could organize to have your finances directly transferred to your bank account. However, the money will be subject to taxation if you next file your tax returns. If you withdraw the funds from your IRA earlier before your age of retirement, an early withdrawal penalty of 10% applies. Therefore, you need a skilled divorce attorney as well as a tax professional when handling issues to do with the splitting of pension money in a divorce case.

Consult a Competent Divorce Attorney Near Me, Specialized in Property Division and Complex Property

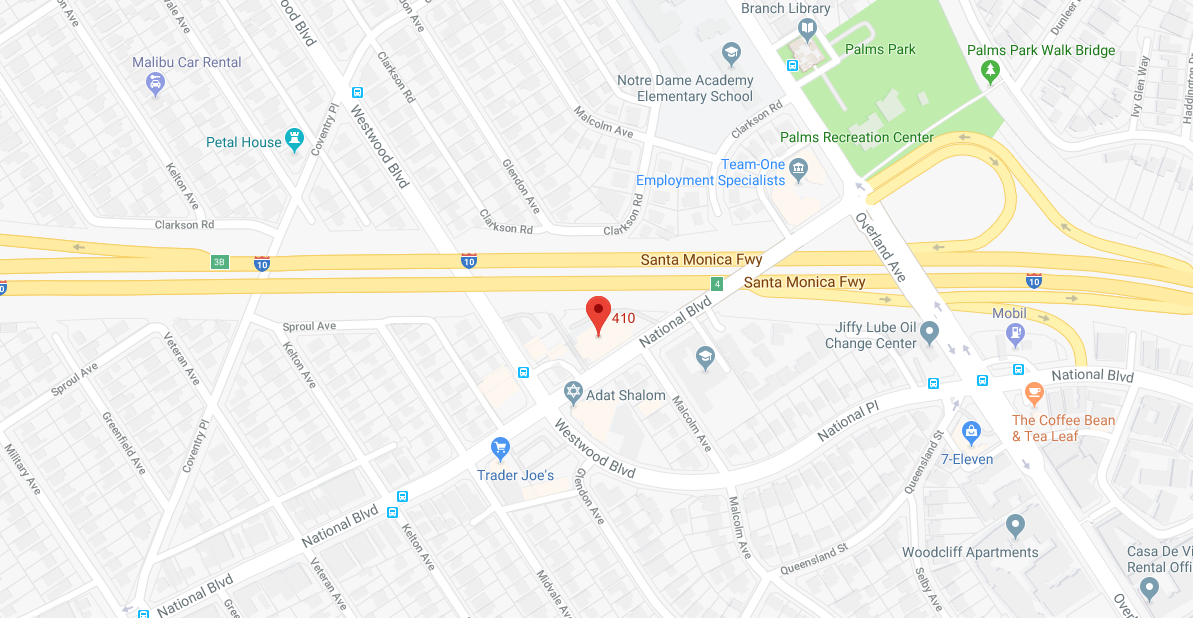

Divorce attorneys exist to help you protect what you’ve earned and to ensure it’s fairly divided so that your family is provided for after the divorce, and you also are left with enough to sustain yourself. Therefore, if you are in the process of divorcing your partner, you must hire a divorce lawyer who is skilled in litigation, negotiation as well as matters of property division valuation, especially complex assets division matters. If you are in Los Angeles, CA, reach the Los Angeles Divorce Lawyer law firm for help with your divorce case. We are well-conversant with California family laws, and we will apply our knowledge in advocating for you. We will do all we can to negotiate a fair division of property, which will enable you to face your future optimistically. Call us at 310-695-5212, so we can get started on your case right away. We are dedicated to helping our clients, which means we can assist with any asset division problem, regardless of how complex.