Marriage and divorce in the United States fall under the jurisdiction of state governments but not the federal government. California is a community asset state. When you want to divorce your partner, you must equally share your community or marital assets and debts. Divorce could also involve child support, child custody, and spousal support. While asset division is the main issue, each divorce is unique, and even what looks like a simple process can become complicated. Unlike ordinary divorce, the executive divorce process is unique in many ways. An executive divorce case requires skilled attorneys like the Los Angeles Divorce Lawyer to help you navigate the process.

Executive Divorce

This is a divorce where one or both spouses are professionals or executives. They could be CEOs, CFOs, or people holding other important positions within a company. Executive divorces can involve the executive directors, employees, officers, and shareholders of companies like large private companies, publicly traded companies, or financial institutions. Executive divorces can also involve self-employed presidents of companies with substantial gross receivables from either partnership or corporate income.

If you are an executive person or a person that owns a small or medium-sized business, indeed your divorce could involve the following:

- The valuation of companies owned or managed by you and your spouse.

- Characterization of the assets and liabilities.

- Asset and debt identification.

A divorce involving couples with high net worth often takes on a new level of difficulty. Generally, this case involves a unique process that, at times, can be accomplished by obtaining a valuation of closely held family corporations. It also involves structuring spousal support in a manner that prevents recapture.

Factors To Consider In An Executive Divorce

Typically, executives are influential in businesses and have other issues they need protection from apart from the financial assets. Therefore, you need to plan well before filing a divorce petition. Spouses must also deal with traditional divorce matters like expenses, debts, and income.

With an executive divorce, partners must maintain confidentiality in their divorce process. You could consider a private judge if you need your company’s financial information or personal income to remain private. However, since any information you file in court is a public record, high net-worth spouses involved in a divorce should keep their information confidential. Any ugly public divorce trial can taint your reputation and your company.

Executives who file for divorce often need special attention because of the added separation elements. Some of the aspects that must be given priority include the following:

- Presentation of equitable arguments in support of unequal distribution.

- Spousal support and how it is structured to avoid recapture.

- Tax consequences of capital gains or capital loss carry-overs.

- Maintenance of a business without interference from the ex-spouse.

- Non-marital assets, spendthrift trusts, and inheritances are to be protected.

- Family corporations or restricted stock that will have to be valued.

Executive Divorce And Marital Assets

When you file for an executive divorce, marital assets include any items acquired or shared during your marriage. Some assets include vehicles, furniture, money, and a family home. The family court will decide if an asset should be deemed separate or communal. You must make your divorce attorney aware of concerns regarding undeclared assets. Your attorney will pursue the matter to ensure that all separate and marital assets are identified and valued. The attorney could seek the services of appraisers, certified public accountants, accountants, forensic accountants, real estate experts, and professional tax advisors.

If the family court establishes that your spouse has intentionally hidden any assets, the judge could award you a high value for that asset.

Additionally, the court will consider your professional career and the effect of your spouse's contribution. The court will also consider the earning potential of the non-executive spouse while determining alimony issues. Finally, you require competent legal representation to speed up the executive divorce process. Litigated executive divorce cases could last months or years and cost you a substantial amount in lawyer fees.

Exclusive Use And Possession Of The Marital Home In Executive Divorce

''Exclusive use and possession'' is the concept that one spouse can stay and use the marital home while the divorce is ongoing or permanently when the divorce is finalized. One spouse is barred from returning to the residence, while the other spouse has exclusive use and possession of the marital home.

An executive divorce process can be highly charged, stressful, and emotional. You could ask yourself whether you should continue living in the same house with your soon-to-be ex-partner until the divorce is finalized. Unfortunately, there are no last and hard laws in California dictating which partner should retain the possession of the shared residency.

Matrimonial homes are often the largest and most contentious property in an executive divorce. Most spouses are left in a gray area during divorce proceedings, whether both or one of them can stay in the home. The court has the power to grant one partner exclusive use and possession of the marital residence. Therefore, you must petition the court for sole occupancy if you want to remain in the marital home. However, if children are involved in the divorce case, the presiding judge will likely give the marital home to the spouse who spends the most time with them.

Generally, most spouses prefer living separately, given the emotional nature of legal separations. But unfortunately, it is common for spouses to fail to reach a consensus on who should stay or leave.

Obtaining An Order For Exclusive Use Of Marital Home

On the other hand, you can obtain an order for exclusive use and possession of the marital home. You can quickly gain temporary exclusive use and possession of the marital home by petitioning the court for a domestic violence injunction or a restraining order. However, you can only succeed in using this strategy by providing substantial reasons for petitioning the court. You are required to provide evidence of the following:

- Domestic violence.

- Abusive behavior.

- Behavior that is psychologically or emotionally detrimental to the children or a risk of physical harm.

A mere feeling of not being satisfied with the living conditions of the children does not justify depriving your spouse of a home.

Common Challenges In An Executive Divorce

Generally, high-profile executive divorces face more challenges than traditional divorces in California. The unique challenges of an executive divorce could be overwhelming, whether you are the spouse of an executive or a high-net-worth executive. The reasons behind the challenges include the following:

- Stock options.

- Bonuses.

- Substantial income and assets.

- A significant amount of property.

Often, an executive family will expect to keep their standard of living. Apart from dividing all the property, you must separate spousal support and mutual agreements for child custody if you file for an executive divorce. In most divorce cases, child custody is always an aggressively litigated matter. Most executives do not like opening their custody issues to public scrutiny.

Executives approach child custody issues carefully since most spouses use children as leverage to get a child custody decision. Executives should resolve child custody and visitation issues early in the divorce process to save them thousands of dollars in attorney's fees. However, you need a skilled family law specialist to obtain favorable results. Company executives need to have their financial liabilities minimized and their reputations protected.

Executive Divorce And Spousal Support

Typically, the California family court would order spousal support if there is a vast discrepancy in income between the spouses. The support is also known as alimony, and the court often arrives at this decision if the spouses fail to reach an agreement. The court considers several factors in deciding on fair spousal support, including:

- Employment history and education level of both spouses.

- Regular salary of both spouses.

- Number of children in the marriage.

- Length or duration of the marriage.

The spousal support awarded by the court is often temporary. Usually, spousal support lasts only a few years to give the alimony recipient time to become self-reliant. Spousal support could be terminated or modified if the receiving spouse’s financial circumstances change. In addition, the alimony-receiving spouse cannot continue receiving support if he/she refuses to work.

According to the IRS, spousal support is income for the receiving spouse. Therefore, the receiving spouse is expected to pay taxes on the money received. Spousal support is also tax-deductible to the spouse paying it.

Using Experts In An Executive Divorce

You can seek the services of an expert in an executive divorce for the valuation of the business or related divorce matters. For example, you could use a forensic accountant or an appraiser if some assets need to be divided or valued. The assets include the following:

- Boat.

- Classic vehicles.

- Antiques.

- Artwork.

- Jewelry.

- Commercial property.

- Marital home.

You and your spouse could sometimes disagree on child custody matters. In this case, the court could appoint a forensic psychologist to investigate some allegations, including:

- Substance abuse.

- Neglect.

- Physical abuse.

- Domestic violence.

Sometimes, your spouse can refuse to work when he/she can. In this case, you could hire a vocational evaluator to review employment opportunities. The California Family Code 4331 also gives the court the power to order a vocational examination to determine spousal support matters. However, you can only hire a vocational evaluator in certain situations.

Most executives in California work hard to protect their businesses and wealth against spousal support and property claims. However, community property laws allow a spouse to seek half of the assets in a divorce unless a prenuptial or postnuptial agreement states otherwise.

In some executive divorces, the property can be regarded as separate property. In this case, it is advisable to consult divorce mediators to ascertain which specific property can be excluded or included during division. During property division, the properties can be excluded or included depending on when and how they were obtained and the extent to which your spouse contributed to your career.

Executive Divorce And Retirement

Most executives make definite retirement plans over the years. These are often vast groups of assets executives share with their spouses. A divorcing executive needs to understand how the law will decide on the division of retirement assets.

According to the law, all forms of income you and your spouse earned during marriage count as shared property. Defined contribution accounts like 401(k), 403(b), or 457, SEPs, and IRAs count as shared property. Pension plans are also regarded as shared property. However, there is a case where one spouse opened a retirement account before marrying their spouse. In this case, the account owner can claim any contributions he/she made to this account before marriage as a separate asset. This will help avoid the division of the money with their spouse in case of a divorce. According to California law, the interest earned on this money is also considered a separate asset.

If the divorce occurs, federal law governs defined contribution plans and how payments should be made under the plans. For example, an executive spouse like a real estate mogul could have a defined contribution plan deemed a shared asset. In this case, the judge will issue a Qualified Domestic Relations Order (QDRO) as part of the divorce. The plan administrator has the powers under QDRO to make payments to your former spouse. According to QDRO, your former spouse can withdraw money from the defined contribution account. He/she can transfer the funds to another retirement account without facing early withdrawal penalties.

Your former spouse can only apply QDRO on retirement accounts according to ERISA (Employee Retirement Income Security Act). Qualified plans covered by ERISA include:

- Severance plans.

- Profit-sharing plans.

- Employee stock ownership plans.

- Deferred compensation plans.

- Private company pensions 401(k).

QDROs cannot distribute assets from supplemental executive reimbursement plans, excess benefit plans, and stock options. Executives of fast-growing technology companies need to understand that QDRO is not necessary for the court to divide property from SEP and IRA accounts. Your former spouse could face early withdrawal penalties and income taxes on the withdrawn money unless the divorce decree upholds withdrawals and transfers. Penal Code 408(d)(6) of the IRS allows ex-spouses to make withdrawals and transfers, making them tax-free.

Retirement asset division in executive divorce is complicated. Professional athletes and celebrities who do not know the process often make costly mistakes that seriously impact their personal finances in the future. Therefore, executives require a competent divorce attorney they can trust to protect their interests in complicated property division cases.

Eligibility For Executive Compensation After Your Divorce

If you are in the process of divorcing and you or your soon-to-be-ex-spouse are the recipients of executive compensation, determining the value of the assets is complex but essential. You could receive executive compensation for past performance that occurred during your marriage. If you receive executive compensation, it will count as a marital asset and be divided equally in divorce.

Executive compensation could include the following:

- Employee stock purchase plans — This plan allows people to buy company stock often at a price that is discounted from the current market price.

- Restricted stock — These are shares of company stock that have been given as either compensation for future performance or an incentive for future performance.

- Stock options plans — These plans give an employee the right to buy stocks at a discount at some date in the future.

- Nonqualified deferred compensation — This compensation is usually used as an added incentive for executives and other highly compensated employees and is also payable in the future.

- Deferred compensation is a fraction of an employee's pay/compensation set aside to be given later. Deferred compensations include stock-option plans, pension plans, and retirement plans.

Tax considerations are also crucial in executive compensation. For example, a massive tax hit can ensue if your ex-spouse receives executive compensation in a lump sum.

You need to consult a divorce attorney if you have received executive compensation, because he/she understands how to determine the amount to be considered for divorce purposes. Your attorney will give you the documents to take to your employer to determine which employment agreements are in place and the amount of compensation accrued. A skilled executive compensation attorney would also effectively represent your interests in court. In addition, he/she will ensure that your marital settlement agreement reflects how executive compensation will be handled.

Find a Los Angeles Divorce Attorney Near Me

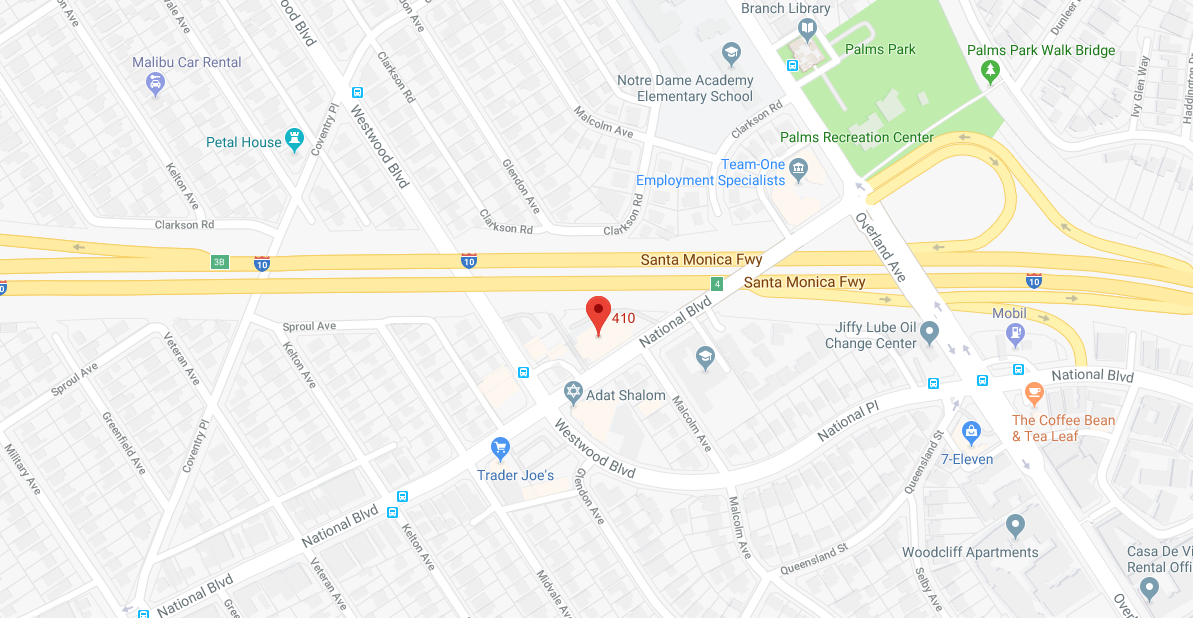

Executives, professionals, business owners, and other people with high-profile careers often encounter considerable challenges during the divorce process. Given their significant assets and complex financial situations, working with an experienced attorney is important to protect their best interests. If you are an executive going through the divorce process, you must protect your rights to the fullest to avoid negative repercussions. You can only do so by seeking the services of a competent divorce attorney. At Los Angeles Divorce Lawyer, we have a team of skilled and experienced attorneys ready to assist you in navigating the justice system. We will provide compassionate and understanding legal counsel and representation. Call us at 310-695-5212 and schedule a consultation with one of our attorneys.