Divorce is a life-altering matter that can be financially and emotionally overwhelming. When bankruptcy comes into the picture, the divorce process may become more intricate. However, divorce is deemed one of the primary reasons for filing bankruptcy since it can disrupt the finances of the divorcing partners. If you are thinking of filing for a divorce or are in the middle of one and are considering declaring bankruptcy at the same time, you should seek legal counsel from an expert divorce attorney experienced in handling bankruptcy and divorce cases. At Los Angeles Divorce Lawyer, our experienced lawyers have a track record of success handling divorce cases that involve bankruptcy. Call us before rushing into making your decision, and we will give you useful legal advice and walk you through the divorce process.

How Bankruptcy Affects Divorce

Bankruptcy and family law often overlap to make a divorce proceeding much tougher. Upon separation, both or one spouse may be incapable of paying the debts they have as a family, or one partner may resort to using bankruptcy filing to gain an advantage. Filing for bankruptcy will impact the divorce proceedings and accompanying aspects like property division except for alimony and child custody or support. If you are in the middle of a divorce, declaring that you are bankrupt will not interfere with any action to establish child support or custody and alimony. However, it will halt the ongoing divorce process related to property division.

Bankruptcy Filing Places an Automatic Stay on Division of Property

When you declare bankruptcy in California, most of your property will become part of your bankruptcy estate. Additionally, an automatic stay will be affected. This provision prohibits any action of assuming control over or obtaining a property that is part of the estate, including any proceeding to divide property that belongs to the estate halfway through the divorce process. How bankruptcy affects property division midway through your divorce will mostly depend on the type of bankruptcy you file (Chapter 13 or Chapter 7 bankruptcy).

Bankruptcy Under Chapter 13

If you declare bankruptcy under Chapter 13 or Chapter 7, the bankruptcy court appoints a bankruptcy trustee to oversee your case. If you declare bankruptcy under Chapter 13, the trustee does not sell your assets to pay out your lenders. Although, the number of non-exempt properties you own impacts the amount of money you will have to pay unsecured lenders through your established repayment plan, meaning that the trustee still needs to establish the value of your property interests.

Additionally, repayment plans for Chapter 13 last between three and five years. Consequently, you or your former spouse will generally have to ask the presiding bankruptcy court permission to continue dividing your assets during your divorce.

Bankruptcy Under Chapter 7

The trustee under Chapter 7 enjoys the discretion to sell all your non-exempt property so they can pay your lenders. This means if you declare bankruptcy in the middle of your divorce process, the trustee has to establish which among your property are part of your bankruptcy estate and whether or not they should sell them to pay out your lenders.

If you and your ex-spouse own property jointly, the trustee may even sell the whole of it if you cannot exempt your interest’s value in the asset. Should the trustee determine that your former partner’s interest in the asset is not included in your estate, they would pay out the ex-spouse their interest value from the proceeds they make from the sale. However, as is evident, declaring bankruptcy when you have pending divorce proceedings may cause both complications and delays in the divorce case.

The Automatic Stay’s Application to Foreclosures

Once you file for a divorce, there is increased fear that your family will come crumbling down. You may not be capable of paying for the home loan or any other major expense when you split up. Declaring bankruptcy under Chapter 13 will stop foreclosure and enable you and your ex-spouse to establish a payment plan and debt restructuring plan for the home loan rearrangements. At least, declaring bankruptcy under Chapter 13 buys you time to hunt for a good apartment within your means.

Alternatively, filing for bankruptcy under Chapter 13 could buy you and your former spouse time to sell your home. You will receive the exempt equity in your home if you sell it at a sheriff's sale but solely after the mortgage, bank's attorney fees, and Sheriff's fees are paid off in full. Experts always recommend that if you are financially constrained, it is best to sell your home in a distress sale instead of losing it in an auction (Sheriff's sale). The automatic stay also applies to bank levies, wage garnishments, and collection calls.

Bankruptcy Effect on IRA Accounts and Cash Value Life Insurance Accounts

As far as pensions and retirement accounts are concerned, you have significant protection if you declare that you are bankrupt. For most retirement plan types, the exemption from lenders is unlimited, meaning the whole amount in the said retirement accounts is protected in bankruptcy. The retirement plans that are fully protected include defined benefit plans, government deferred benefit plans, money purchase plans, profit-sharing plans, stock bonus plans, employee annuities, Keoghs, 403B, and 401K.

However, IRAs (inclusive of both Roth and traditional IRAs) will be exempt from lenders during the bankruptcy period only up to a given limit. The limit is quite considerable (over one million dollars for every person, adjusted every three years). Social security and veteran benefits are also exempted in bankruptcy under federal law, which applies to California residents.

In California State, a life insurance's cash value exemption is capped at a given amount, provided you name the asset beneficiaries and satisfy other requirements.

Bankruptcy and Attorney Fee In a Divorce

Divorce is often psychological warfare. Usually, the court requires that the husband pays the wife's attorney fees, which may be ten thousand dollars or more. This could affect a person's pocket and morale.

Cases of ex-husbands declaring bankruptcy after divorce proceedings end are common. And more often, the filing husband will include their ex-wife's attorney charges as a debt on his bankruptcy schedule. As a result, the attorney's fee as a debt that can be discharged after bankruptcy filing becomes a big problem. The primary question here is whether or not the lawyer fee debt is considered a property settlement or support obligation claim.

The state's bankruptcy court declared the duty to pay attorney fees and spousal support as non-dischargeable. If your ex-husband tries to discharge an attorney fee award, you want to file an adversary proceeding with the Bankruptcy Court. Filing an adversary proceeding will make the court hold a hearing to look into the matter, and the judge will determine whether the attorney fees award is a support obligation and non-dischargeable. Similarly, the court may decide the lawyer fees award was an equitable distribution that is considered dischargeable. The court may also order the restructuring of the payment terms.

The Automatic Stay’s Exception on Alimony and Child Support or Custody

Whereas an automatic stay stops property division during a divorce proceeding, it does not apply to any action to establish child support, custody, or alimony. The United States Bankruptcy Code protects children’s rights to receive support from parents. If you are in the middle of deciding who acquires child custody or whether either of you will need to pay child support, declaring that you are bankrupt will not bar the proceedings from continuing, and child support or alimony will never be discharged.

If your former spouse has declared bankruptcy under Chapter 7, their property is sold to pay out their debts. Most of the outstanding debt is discharged, but alimony or child support in past-due child support or arrears are not dischargeable. If your former spouse is declaring bankruptcy under Chapter 13, they will need to establish a repayment plan for alimony or child support in arrears and make all the court-directed support payments. If you wish to know what you must do to ensure you receive the child support award in bankruptcy, the answer is nothing. In this situation, the law favors you.

Other debts that are non-dischargeable even if you declare bankruptcy during ongoing divorce proceedings are court fines or penalties, student loans, fines ordered by government entities, and legal fees that have to do with child support and custody matters.

Which Should You Consider First Between Declaring Bankruptcy and Filing for a Divorce?

Most people think of divorce as one of the leading reasons for them declaring bankruptcy. However, planning well can make your divorce and bankruptcy more cost-effective and less complicated. Whether you must declare bankruptcy after or before filing for a divorce in California depends on what Chapter of bankruptcy you plan to declare and how much debt and the amount of property you have. Apart from that, there are also other aspects you need to consider, as we will see in this section.

Income Qualification Under Chapter 7 Bankruptcy

If you wish to declare a Chapter 7 bankruptcy, the decision to file after or before your divorce boils down to your income should you start managing a single household. If you intend to submit a joint petition, you must include your joint income in the bankruptcy paperwork. If your combined income is a lot more and you do not pass the means test, you may not be capable of qualifying for bankruptcy under Chapter 7.

This could occur even if the individual income of you and your spouse is low enough to be eligible for filing separately. This is because income limits under Chapter 7 are dependent on the size of the household— a household limit of two is not twice that of a one-person household (it is often just slightly higher). In this case, you may need to wait until both of you have a separate household after your divorce to declare bankruptcy.

Wiping Out Marital Debt

Deciding what debts ought to be allocated to what spouse during a divorce is often time-consuming and expensive. Additionally, ordering one partner to repay a certain debt in a divorce judgment will not change the other partner’s duty towards that lender.

For instance, say during the divorce proceeding, the court directed your former husband to repay a credit card debt you acquired jointly. If he files for bankruptcy and does not pay the debt, you will still be responsible for that debt. This means the lender can pursue you for the collection of the debt. If you pay the debt, you will have the right to be compensated by your former husband since he violated the terms of the divorce judgment (divorce decree).

Although, trying to obtain compensation from your former spouse will often mean spending a lot of money to pursue them in court. Consequently, it might be best for you and your spouse to declare bankruptcy and discharge your combined joint debts before filing for a divorce.

Property Division

Discharging your debts together through bankruptcy simplifies the process of property division during a divorce. But before filing bankruptcy jointly, you must ensure that the law allows you adequate exemptions to the property you and your partner own. Certain states would let you double the exemption amount even if you are filing jointly, but California is not one of them. Therefore, if you own much property, submitting a joint petition may not be ideal if you cannot double your exemptions. The best move is to file bankruptcy separately after the assets have been divided in the divorce. Additionally, note that, as we mentioned, if you declare bankruptcy in the middle of a divorce, an automatic stay prevents the asset division process from continuing until the bankruptcy period ends.

The Bankruptcy Period Under Chapter 13 Vs. Chapter 7

Chapter 7 is considered a liquidation bankruptcy meant to discharge your unsecured debts like your medical bills and credit card debts. Under Chapter 7, your unsecured debts are discharged after just some months. Therefore, the bankruptcy period can quickly elapse before you file for divorce.

On the contrary, bankruptcy under Chapter 13 lasts between three and five years since you must repay all or some of your debts through a repayment plan. Therefore, if you wish to declare bankruptcy under Chapter 13, it may be best to file separately after the divorce proceedings since it will take longer to complete.

Divorce Costs and Bankruptcy

Bankruptcy filing charges are the same for individual and joint filings. Therefore, submitting a joint petition with your wife/husband before a divorce filing will save you much money in legal charges. Additionally, if you retain a bankruptcy lawyer, your lawyer charges will likely be much cheaper for joint filing compared to if you and your spouse filed separately. Although, you should inform your bankruptcy lawyer about your nearing divorce since there might exist a conflict of interest for them to represent the two of you. Declaring bankruptcy before filing for a divorce may also streamline the matters concerning property division and debt and reduce your divorce charges consequently.

Are You Filing Together (Joint Petition) or Separately?

A California bankruptcy case commences when a business, married couple, or an individual files official bankruptcy paperwork with the court. For a husband and wife filing together, they will bring a joint petition that contains their financial information in a single set of documentation.

Often, divorcing couples file bankruptcy together since they see it as more efficient. For instance, bringing a joint petition is beneficial in the following ways:

- It costs much less to declare bankruptcy jointly as compared to when spouses file individually

- The bankruptcy wipes out (discharges) the qualifying debts of both partners, therefore minimizing the matters to be determined by a divorce judge.

However, it is not a must that married couples file bankruptcy together. If one partner requires bankruptcy protection right away, individual filing may make more sense. Alternatively, each spouse may find it much easier to be eligible for bankruptcy filing after finalizing the divorce because of a mutual reduction in income. However, when it is practical, most couples deduce that bringing a joint bankruptcy petition simplifies the divorce procedure.

Find an Experienced Divorce Attorney Near Me

There are various areas where family law and bankruptcy law overlap. In certain cases, declaring bankruptcy in the middle of your divorce proceedings may cause complications or unnecessary delays. If you are in the middle of a divorce process, talk to an experienced divorce attorney to learn more about how declaring bankruptcy may impact your pending divorce case. Every divorce case is unique. Therefore, you and your partner should think through your situation carefully before deciding what the right action is, and one of the ways of doing this is to seek legal counsel.

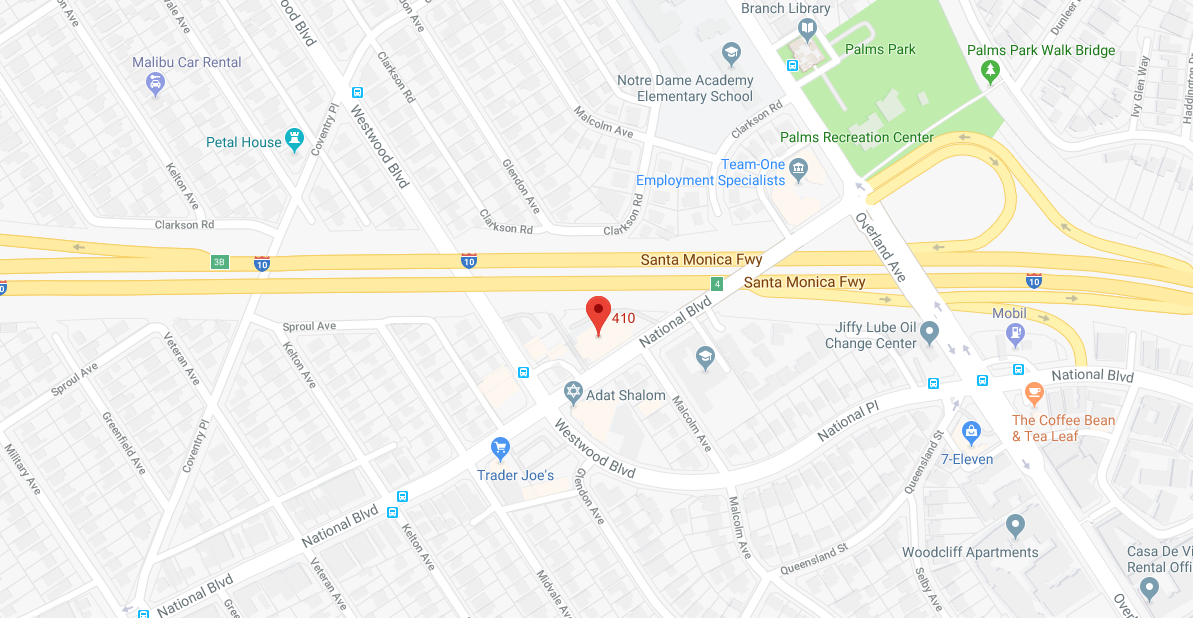

At Los Angeles Divorce Lawyer, we boast in-depth knowledge of the state’s bankruptcy and divorce laws and several years of experience handling these cases. If you are in the middle of a divorce process in Los Angeles and you or your spouse is thinking of filing bankruptcy or are wondering what to file first between bankruptcy and divorce, call us at 310-695-5212 for a consultation and help on how you can handle the situation.