If you are contemplating ending your marriage in California, you should be well acquainted with the California Family Code sections on Fiduciary Duties. Spouses owe each other different duties. Spouses need to realize that they are under legal obligations to each other. Failing to understand and comply with these duties could have severe and costly implications. Contact the Los Angeles Divorce Lawyer for information on when fiduciary duties arise in a relationship, your obligation, and the consequences for breaching fiduciary duties.

Fiduciary Duty Explained

In many ways, a marriage is like a business partnership between two people. The fiduciary duties of spouses are spelled out in California Family Code 721. Generally, married couples are guided by similar rules that apply to business partners. Upon divorce, each partner has the right to an undivided interest in half of the family estate. In addition, legal remedies are available if either party breaches their fiduciary duty in divorce.

It is essential to understand when a fiduciary duty applies and what constitutes a breach to determine the liable party when a breach occurs in divorce. Often, a fiduciary duty is an obligation of good faith and loyalty of the highest order to someone or entity referred to as a beneficiary. The person with the duty owes the beneficiary the highest level of devotion and care. You must act with your partner's best interests in mind at all times and refrain from taking any action that could harm your partner or the beneficiary's interests.

You must disclose all possible conflicts of interest to your spouse and discuss them. In some circumstances, this could require you to proactively investigate what would be in your spouse's best interest and act accordingly. Each partner must act in the best interests of the other in all economic and other dealings.

How Breach Of Fiduciary Duty Claims Arise In A Divorce

Often, the claims of breach of fiduciary duty arise in a divorce when one spouse takes financial advantage of the other in a transaction between them. Usually, the typical actions that could qualify as a breach of fiduciary duty in a divorce include:

- One partner concealing or hiding an asset occurs when one partner takes formal ownership or title to a property in their name, and the other partner is unaware of the asset's existence.

- When one partner sells an asset without the consent of the other partner

- When one partner gifts another person a property without the knowledge of the other partner Often, this is common when one spouse gifts a friend or family member

- Fraudulently transferring an asset to someone else without receiving the asset’s fair market value in return — This happens when one partner transfers an asset to a close friend or a family member to hide the existence of the property. The fraudulent partner could later claim that the property is not community property.

Some transactions that occur between couples during the marriage could cause a breach of fiduciary duty claim during a divorce. For example, a husband could request the wife to sign a deed removing the wife from their homeownership even though the home is a community property. The husband can accomplish this by lying to the wife about the reason for the transfer. The act of lying prevents the wife from suspecting an intention of malice.

Breach of fiduciary duty in divorce could also go beyond marital assets. For example, one partner could borrow or encumber community assets without the other partner's knowledge.

Proving Breach Of Fiduciary Duty In Divorce

If your spouse suspects you are guilty of a breach of fiduciary duty, then he/she has the burden to provide sufficient evidence in the case. Your spouse must provide substantial evidence showing that you are an agent, partner, trustee, or are related in any other way that creates a fiduciary duty. Your partner must prove that you breached that duty and caused them harm.

Often, proving this is not easy unless your spouse seeks the services of an attorney. To prove your breach, your spouse must begin by establishing that the fiduciary duty was present. Once your spouse has proved that fiduciary duty was present, the next step involves providing evidence indicating that you did not uphold that duty. Acts like self-dealing, embezzlement, and commingling of estate assets amount to a breach of fiduciary duty. These acts further your benefit but not the benefit of your spouse.

Determining Liability In A Breach Of Fiduciary Duty

A breach of fiduciary duty happens if you fail to fulfill your obligations to your partner. For example, you could face legal consequences if you act to benefit yourself at the expense of your spouse. In addition, you could face repercussions if you are purposely dishonest in your business practices or fail to adhere to disclosure and loyalty duties. Liability in breach of fiduciary duty could be as follows:

Joint Fiduciary Liability

Co-fiduciaries could lead to joint executors or joint trustees, meaning the obligations and any arising liability is ''joint and several''. If co-fiduciaries breach their duty, causing each other harm, each could be individually responsible for the damages.

Personal Liability

At times, you (fiduciary) could be held responsible if you breach your fiduciary duties towards your partner. Usually, in this case, you will be personally liable for the resulting damages.

Third-party Liability

Under California law, a third-party party could be liable for knowingly playing a part in your breach of fiduciary duty. The third party could be responsible even if he/she does not owe a fiduciary duty to your spouse. This theory applies if a third party intentionally plays a role in your breach of duty. For example, you could request a disloyal real estate agent to sell your family estate. The agent sells it at an unfairly low price and gives you a kickback. In this case, the agent played a part in your breach of fiduciary obligation to your spouse. The breach could not have happened without the active participation of the third party (agent).

Damages Recoverable In A Breach Of Fiduciary Duty In Divorce

Several damages are recoverable in a breach of fiduciary duty case. They include:

Mental Anguish Damages

Mental anguish is non-economic damage your partner could recover in a breach of fiduciary duty case. It compensates for suffering like:

- The hurt that comes from losing money or property

- Hopelessness or fright

- Feelings of distress

- Grief

- Anxiety

- Depression

The offended partner must provide evidence of their anguish's severity, nature, or duration to recover the relevant damages. Your distress must also affect your spouse’s daily routine and amount to a high level of psychological pain that exceeds worry, anger, vexation, and embarrassment. Some of the mental anguish evidence the offended could provide includes:

- Treated anxiety attacks

- Insomnia

- Treatment for depression

- Ulcers or pain that caused them to seek medical attention

Equitable Relief Damages

Often, the court could grant your spouse an equitable relief to prompt you to act or to stop performing a particular act in situations where legal remedies are not an option to offer substantial restitution. The court could also penalize non-compliance with criminal or civil punishment.

Jurisdictional clauses, which impose equitable relief often, demand that you and your spouse acknowledge that legal relief is not enough to compensate for the breach of fiduciary duty.

Legal relief serves as a reminder that a breach would cause irreparable damages. The two spouses also acknowledge that a breach of fiduciary duty could cause the offended partner to seek an injunction or another form of equitable relief. However, the offended partner must be free from blame in the breach, also known as the ''clean hands'' principle. This principle could be used to deny equitable relief if the offended does not act in good faith and unnecessarily delay in seeking a remedy.

A typical form of equitable relief involves ordering a partnership rescission that cancels all duties and terms and restores couples to their pre-partnership position. Often, this happens in a partnership involving property because the personal value of property to an individual can extend beyond monetary compensation. The court could cancel the partnership or order the property to be sold according to the terms of a partnership.

Economic Damages

Economic damages could include past and future lost wages, property damage, lost earning capacity, out-of-pocket expenses, and household services. In a divorce case, your spouse must devise a proper measure of damages in a breach of fiduciary duty. One measure of the damages your spouse could use is lost profits. California law highlights the rules for determining a claim for profits in a breach of fiduciary duty in a divorce case. The instructions include the following:

- To receive economic damages, the offended partner must provide ample evidence showing that he/she would have earned profits were it not for the defendant’s behavior.

- To settle on the amount of economic damages, the attorney must ascertain the gross amount the offended partner could have received were it not for the defendant’s behavior. The attorney does not need to calculate the amount of the lost profits using mathematical precision. The attorney only needs to have a reasonable basis for computing the loss.

Exemplary/Punitive Damages

The offended partner in a breach of fiduciary duty in divorce could recover economic and non-economic damages. However, exemplary damages are hard to recover under California law. In limited situations, the offended partner can successfully recover exemplary damages. The offended partner can only receive exemplary damages if your actions in a breach of fiduciary duty were extreme and malicious.

Exemplary damages can be awarded to your spouse to punish you for your actions. These damages are solely awarded as a penalty for malicious and incredibly reckless conduct. These damages are usually granted in addition to economic and non-economic damages your spouse could recover.

Exemplary damages are not available in every breach of fiduciary duty lawsuit. California limits the circumstances when you could be punished monetarily for your actions. Your conduct must rise above simple misconduct or negligence. Your spouse will only receive exemplary damages if there is clear and convincing evidence that you are guilty of malice, oppression, or fraud.

Family Code 1101 Under California

In California, Family Code Section 1101 provides powerful remedies in cases involving a breach of fiduciary duty in divorce. According to this statute, any spouse that conceals and fails to disclose marital or community assets could be ordered to pay their spouse 50% of the concealed property. In addition, the court could also order them to pay the attorney's fees and the costs incurred by their spouse to file a lawsuit.

Your spouse could request Family Code 1101 remedies that include sanctions and damages. For example, he/she could do so if you breach fiduciary duty in a divorce by intentionally concealing valuable community property.

Your spouse will be required to commence the request by filing a notice of motion or request for order. Family Code 721 of California law also has provisions for filing the motion. If the judge determines that oppression, fraud, or malice was evident, the court could order you to pay 100% of the value of the concealed community property. The judge also has the right to use their discretion to order you to pay the attorney fees and the costs incurred by your spouse in filing the motion.

Family Code 1101 gives other conditions if you breach fiduciary duty in a divorce as follows:

- The name of your spouse could be added to the community property held in your name

- The judge would order an accounting of the duties and property of both spouses

- The judge could rule on the rights, ownership, access, beneficial enjoyment of community assets, and classification of all spouses' assets.

The offended partner has a four-year statute of limitations to file a breach of fiduciary duty lawsuit against the defendant in California. The statute of limitation begins from the date one spouse discovers the violation unless one of the parties passes on.

Defenses To Breach Of Fiduciary Duty Charges

Often, upholding fiduciary duties in divorce is more complicated than most people could think. For example, you could disagree with your spouse on your decisions. While these disagreements can be resolved informally, your spouse could accuse you of breaching your fiduciary duty in a divorce. If you find yourself in this situation, you must know how to contest the accusations before the court, lest you face severe repercussions. Some of the defenses you could raise include the following:

Ratification

This is one of the standard defense options you could present to contest the charges against you. You could allege that your spouse approved your decisions based on the full knowledge of your actions and to approve those actions. The court will scrutinize your and your spouse's evidence to ascertain if your spouse agreed with the steps you took or if he/she consented to those actions.

Unreasonably Delaying The Claim

If you face breach of fiduciary duty accusations in court, several options are available to defend yourself. In many instances, you could raise a latch defense successfully.

For example, you could allege that your spouse waited too long to file the claim. However, you must provide sufficient evidence to succeed in this defense. You will have to consider the circumstances surrounding the accusations. You must also consider when your spouse first brought the claim to light. You could also allege that you were disadvantaged by the delay.

Expired Statute Of Limitations

One key thing about the statute of limitation is that the clock starts ticking when your spouse discovers the violation or breach of fiduciary duty. Although this could seem like a relatively minor issue in a breach of fiduciary duty lawsuit, it can considerably affect the outcome of the case. The statute of limitations for a breach of fiduciary duty in divorce in California is four years. Your spouse cannot file a breach of fiduciary duty lawsuit against you after the expiry of the statute of limitations. This means he/she loses the ability to recover damages.

However, there are a few situations in which your spouse could be allowed to file a lawsuit even though the statute of limitations has technically expired. If your spouse is mentally incompetent, the statute of limitations must be extended until he/she recovers. However, in most situations, a friend, family member, or someone else could be appointed as a guardian with the authority to proceed on behalf of the incapacitated spouse.

Find A Los Angeles Divorce Lawyer Near Me

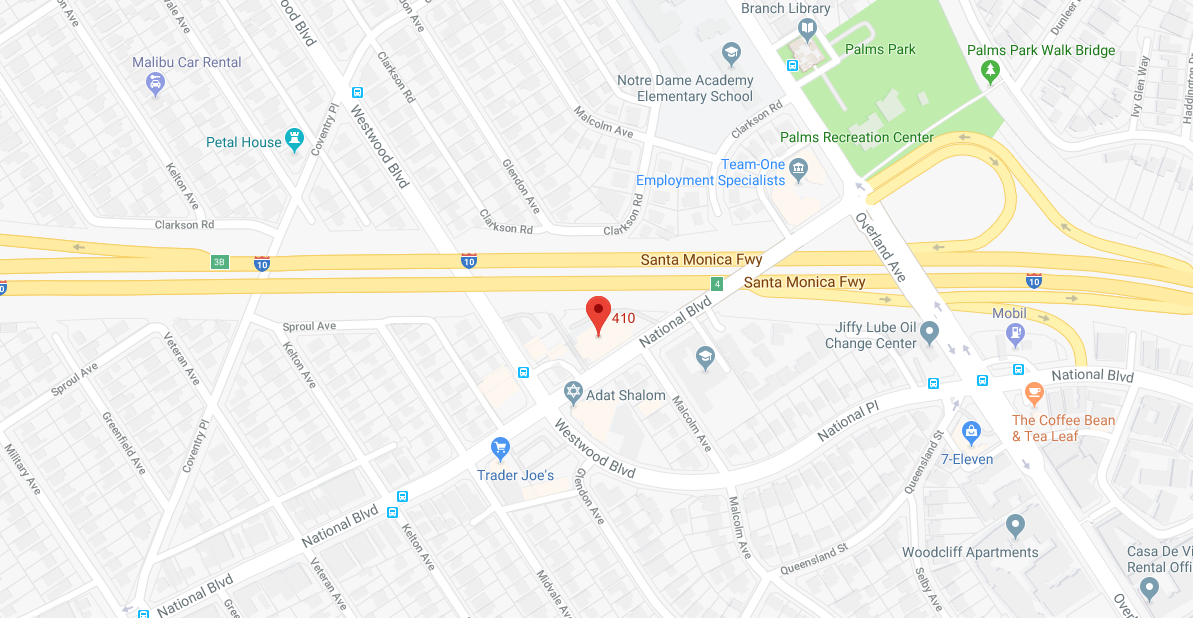

Like everything else in family law, the rules surrounding the breach of fiduciary duty in divorce are not always clear. A seemingly harmless action could result in a violation of your fiduciary duty towards your spouse. When faced with the technical aspects of a breach of fiduciary duties in divorce, you need an experienced attorney by your side to guide you. At the Los Angeles Divorce Lawyer, we have highly experienced attorneys who understand all areas of divorce. Our lawyers will examine the evidence against you and advise you on the best course of action. For reliable legal representation, contact us at 310-695-5212 to speak to one of our attorneys.